Key Takeaways

- Bitcoin falls below $118,000 as altcoins experience significant losses.

- The leading cryptocurrency may drop below the $116,000 support level if bearish sentiment intensifies.

Bitcoin Stagnates Around $117,000 While Altcoins Suffer

The cryptocurrency market has experienced a downturn over the past 24 hours, following a brief bullish trend in the preceding days. Bitcoin, the largest cryptocurrency by market capitalization, has decreased by less than 1% and is currently trading at approximately $117,000.

In contrast, altcoins have recorded substantial losses during this correction. XRP has fallen by 11%, potentially dropping below $3.00, while Ethereum may dip under $3,500 after losing 3% of its value.

Other major cryptocurrencies, including Solana, BNB, TRX, ADA, and Dogecoin, are also seeing red. This bearish trend has contributed to a 2.6% decline in total cryptocurrency market capitalization, now standing at $3.85 trillion, just days after hitting an all-time high of $4 trillion.

Bitcoin at Risk of Falling Below $116,000 if Selling Pressure Increases

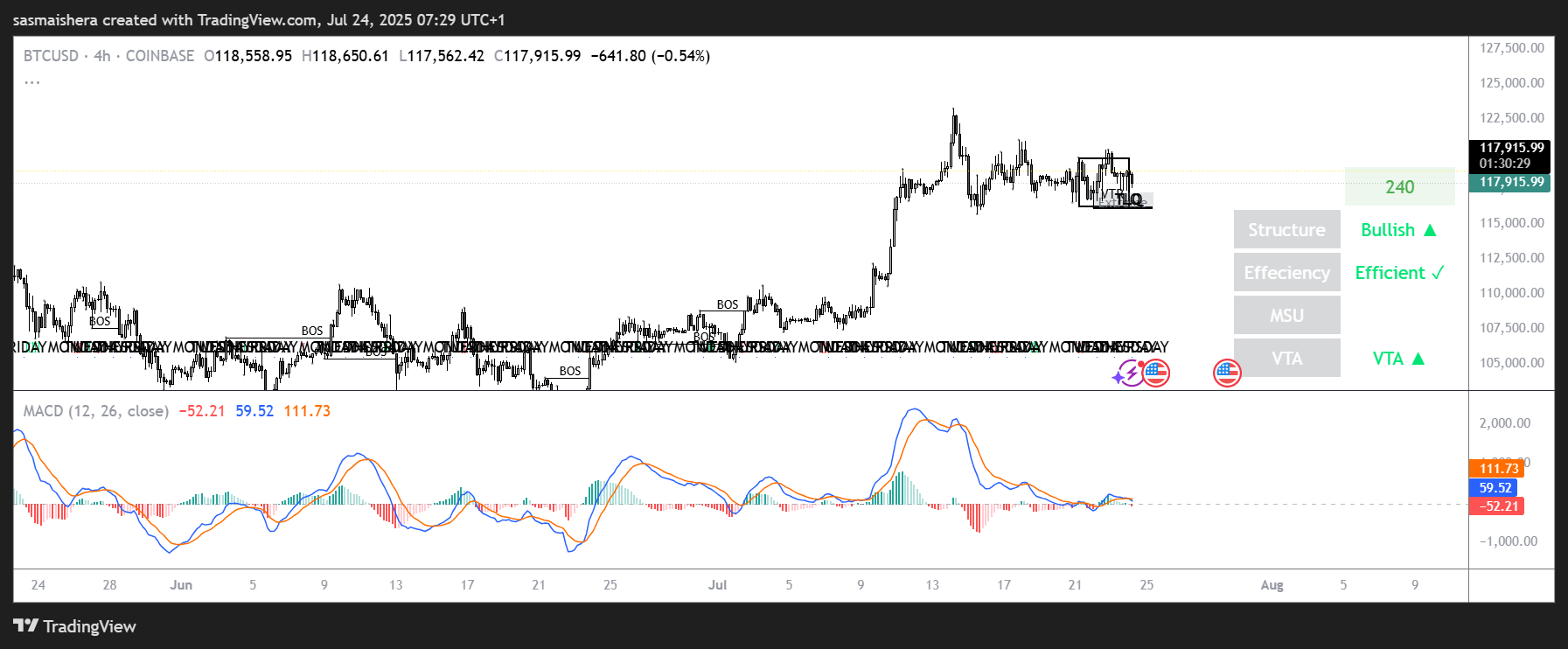

The 4-hour BTC/USD chart remains bullish and effective, indicating that buyers still maintain control despite signs of weakness. Technical indicators continue to show bullish momentum but have slowed in recent days.

Currently, the pair is in a consolidation phase, with potential outcomes including a rise to a new all-time high or a downward correction. Bitcoin may likely retest the $116,000 support level and the TLQ level in the coming hours. The TLQ could act as liquidity to push the price of Bitcoin higher; however, failing to defend this level may result in a significant decline.

The MACD lines are in the neutral zone, suggesting that the market is consolidating. The RSI of 51 indicates that buyers are losing control over the market.

If buyers fail to defend the $116,000 support level, Bitcoin could experience a significant drop toward the next support level at $112,000. Conversely, if the TLQ at $116,000 serves as a springboard, it may propel Bitcoin above the $120,000 resistance and toward a new all-time high.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.