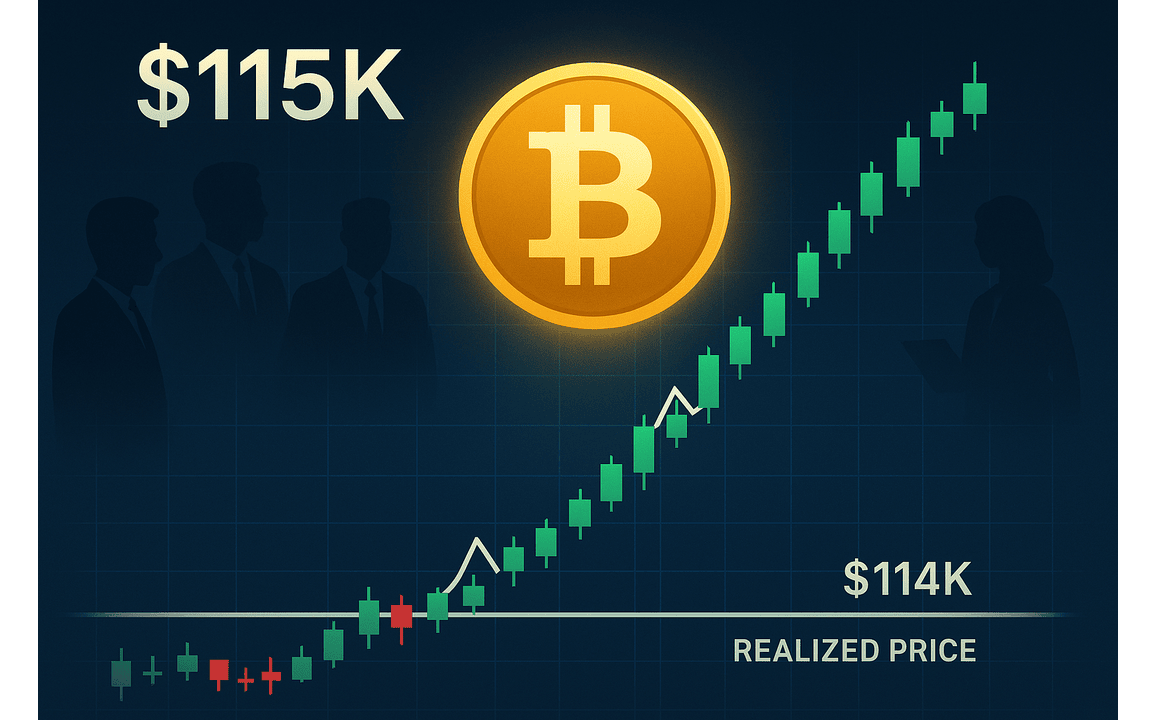

Bitcoin’s recent surge has propelled its price above $115,000, energizing market sentiment and attracting the attention of investors. This milestone comes as analysts provide varying forecasts for the leading cryptocurrency’s future, with some predicting further gains as the year draws to a close.

Bitcoin Surpasses Key Price Thresholds

In September, Bitcoin marked a notable increase, climbing from approximately $108,000 at the month’s beginning to over $115,000. Despite only a modest gain of 4% over two weeks, on-chain data imply that the cryptocurrency may be gearing up for another upswing potentially leading to new all-time highs.

According to an analysis on CryptoQuant by contributor ShayanMarkets, the price rebound from $107,000 to $114,000 has allowed Bitcoin to surpass the realized price for mid-term holders—those who last moved their coins between three and six months ago. This realized price currently stands at nearly $114,000, representing a pivot point that often correlates with market sentiment and selling pressure.

By breaching this threshold, Bitcoin appears to have diminished the likelihood of immediate selling from this cohort, with ShayanMarkets noting that a firm breakout and consolidation above $114,000 could signify renewed confidence among mid-term holders. If achieved, this may set the stage for a new bullish phase that could advance Bitcoin towards record levels. Nonetheless, the analyst cautioned that any failure to maintain this level could erode sentiment, opening the door for deeper corrective movements in the short term.

Short-Term Holders Display Signs of Stress

Conversely, other on-chain signals present a more cautious view. Contributor Gaah of CryptoQuant highlighted the behavior of short-term holders (STH) through the spent output profit ratio (SOPR), adjusted with a 30-day moving average. This metric gauges whether investors are selling their coins at a profit or loss.

Gaah observed that after four months of trading above breakeven, the SOPR for short-term holders has dipped into negative territory, indicating that these investors are now experiencing losses. This trend suggests a temporary loss of confidence among speculative investors, who are typically more sensitive to price fluctuations.

Despite Bitcoin’s broader rise from $60,000 to $125,000 over the past year, the STH SOPR has shown declining peaks. Historically, significant price rises have been coupled with SOPR readings in the “Extreme Greed” zone, reflecting strong retail interest. However, such dynamics have not materialized this time, implying that institutional investors may be driving the recent gains. Gaah added that peaks in the market are usually confirmed when short-term holders exhibit extreme greed, which has not yet occurred, suggesting that the current pullback could merely represent healthy consolidation rather than a long-term reversal signal.

Mixed Outlook as Year-End Approaches

Market observers remain divided on Bitcoin’s short-term outlook. Some analysts caution that the cryptocurrency may be nearing the peak of its current cycle, while others anticipate a short-term slowdown in September followed by a new rally in the fourth quarter of 2025. Predictions vary widely, with some forecasting a price of $150,000 by Christmas if bullish momentum persists.

At present, Bitcoin is trading at $115,050, reflecting a 0.7% increase over the past 24 hours as it attempts to establish support above critical levels in its chain. With both bullish and cautious signals present, investors are closely monitoring Bitcoin’s ability to maintain its position above the realized price of mid-term holders, as this will likely determine if the next rally phase begins or if a deeper correction unfolds.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.