Concerns have surged within the crypto community regarding Pump.fun’s treasury management following significant USDC transfers to Kraken. This situation has sparked discussions about the project’s financial transparency and the implications for its token market.

Significant USDC Transfers Raise Eyebrows

- Lookonchain reported a staggering $436.5 million in USDC moved to Kraken.

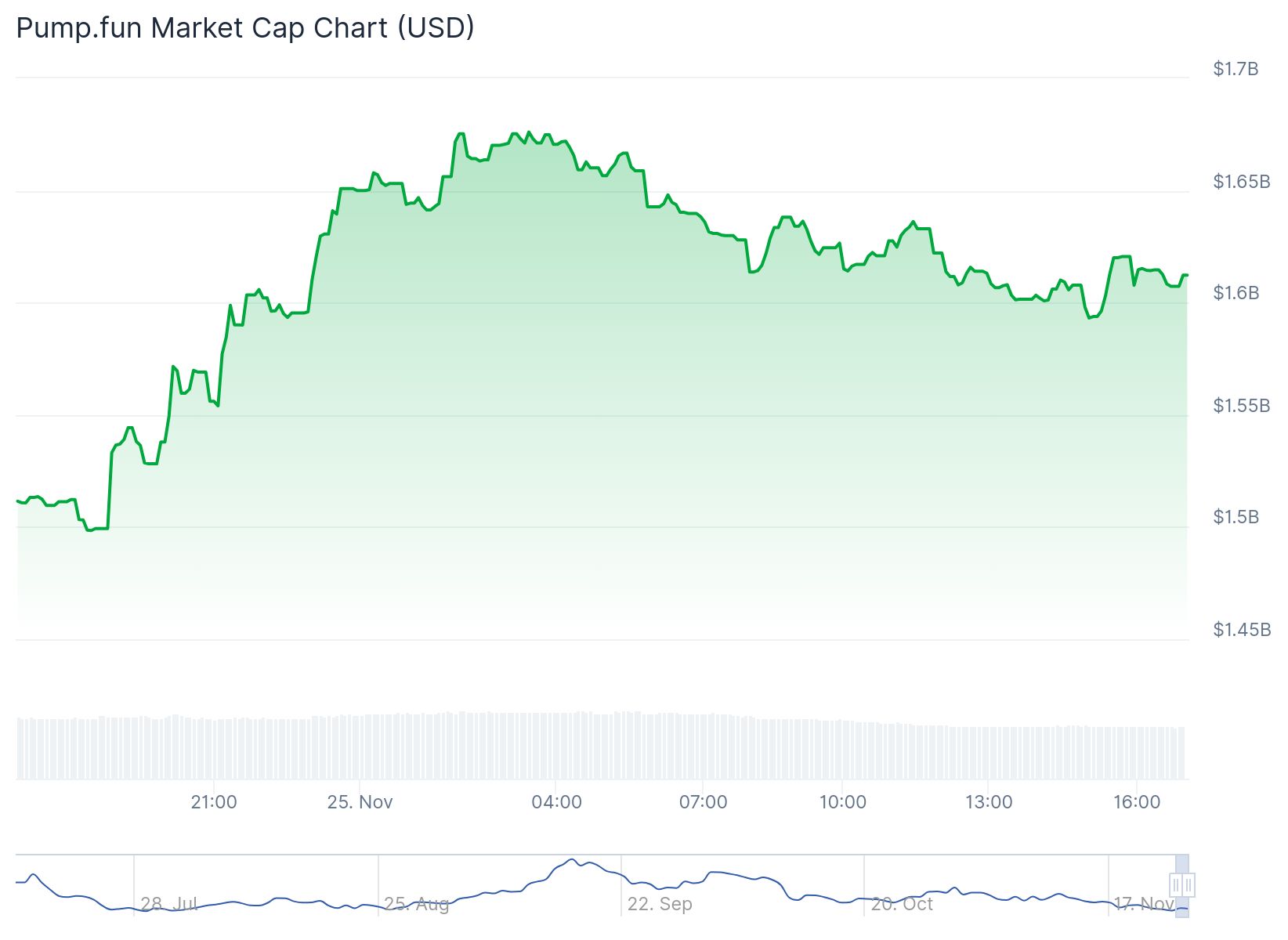

- The project’s revenue plummeted to $27.3 million in November.

- Despite transfers, wallets still hold over $855 million in stablecoins and $211 million in SOL.

After co-founder Sapijiju challenged claims that Pump.fun had liquidated over $436 million in stablecoins, the platform’s treasury activities garnered intense scrutiny. This scrutiny intensified when Lookonchain revealed that wallets associated with the Solana-based Memecoin launchpad had executed significant transfers of USDC to the Kraken exchange.

This activity raised alarms about potential selling pressure and doubts surrounding the project’s reserve management. The narrative quickly gained traction on social media, where users analyzed the financial movements and debated the company’s transparency.

Internal Management and Community Reactions

In a post on X, Sapijiju defended the transfers, stating they were part of Pump.fun’s treasury management rather than sales. The post clarified that the USDC originated from the initial coin offering (ICO) of the PUMP token and was moved among internal wallets to facilitate reinvestment plans.

According to Sapijiju, Pump.fun has never had dealings with Circle. Treasury management typically includes reallocating portfolios and budgeting, which doesn’t necessarily indicate liquidation or sales.

The Lookonchain report confirmed that USDC transfers to Kraken had accumulated to $436.5 million since mid-October. This revelation coincided with a distressing drop in Pump.fun’s monthly revenue, down to $27.3 million in November — the first figure below $40 million since July, as reported by DefiLlama.

Despite the unsettling numbers, data from DefiLlama, Arkham, and Lookonchain indicated that the tagged Pump.fun wallet had retained over $855 million in stablecoins and $211 million in Solana (SOL), which was trading at $136.43.

Market Dynamics and Future Implications

Research analyst Nicolai Sondergaard from Nansen interpreted the reported transfers as a potential indicator of future sales. In contrast, EmberCN posited that this activity represented institutional investments in the PUMP token, not active dumping.

This dichotomy of views has prompted broader investigations into the project’s performance and token structure. CoinGecko data revealed that PUMP traded at $0.002714, down 32% from its ICO price of $0.004 and nearly 70% from its September peak of $0.0085. Currently, PUMP is priced at $0.002738, reflecting a 6.9% increase over the past 24 hours.

The price fluctuations have intensified community discussions regarding whether treasury actions aligned with market conditions for the token. Opinions within the community have diverged, with some users arguing that the explanations raised further questions about inconsistencies, demanding clearer communication. Others dismissed these claims, connecting treasury activities to concerns regarding token performance.

A segment of users contended that Pump.fun has the right to manage its ICO revenue and reserves as it sees fit, referring to treasury movements as standard practice following an ICO. They asserted that the key issue remains whether the USDC reserves adequately support the circulating supply.

The Centrality of Treasury Structure

As users continued to scrutinize the flow of funds, discussions evolved from sale pressure to the broader treasury structure of Pump.fun. Focus shifted to the magnitude of reserves, how the project organized its wallets, and if the team provided sufficient transparency regarding its financial management.

The existence of over $855 million in stablecoins indicated that substantial capital remained under the project’s control. Nevertheless, users persistently questioned the timing, communication, and purpose behind these transfers. These circumstances highlighted how treasury management can become a contentious subject, particularly amid declining revenue, volatile token prices, and community skepticism.

With ongoing attention on financial movements on social media platforms, the dialogue has turned to expectations for transparency, reserve support, and the company’s approach to fostering long-term development.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.