Axie Infinity (AXS) has crossed the $2 threshold, reflecting a renewed interest among GameFi investors. On-chain data indicates a rise in exchange balances and a reduction in holders, suggesting volatility ahead despite the current bullish momentum.

Significant Price Recovery for AXS and Market Dynamics

In the past week, Axie Infinity (AXS) has surged by nearly 92%, demonstrating a resurgence in investor interest. Today, within just 24 hours, the token rose by 19%, currently priced at $2.406. This change represents a robust recovery from a low of $1.06 registered earlier this week.

Additionally, AXS’s market capitalization has reached $407 million, supported by over $1 billion in daily trading volume. This activity underscores strong liquidity and demand propelling the current rally, fueled in part by a newfound optimism in the GameFi sector. Investors are increasingly drawn to projects like Axie Infinity, which merge gaming with blockchain incentives. South Korean traders, in particular, have significantly contributed to the token’s revival, often trading AXS at a premium on major exchanges.

Moreover, the development of the bAXS token promises new staking advantages, adding further momentum to the ecosystem.

On-Chain Data Signals Caution

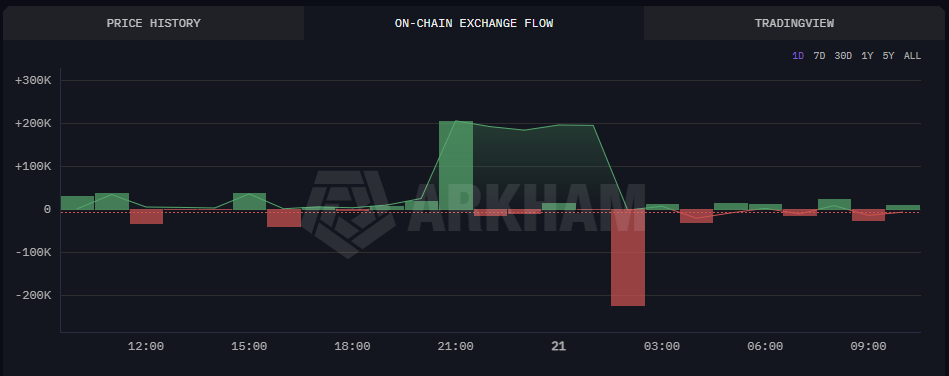

Despite this bullish momentum, various on-chain indicators advise caution. The number of AXS holders has sharply declined over the past week, suggesting profit-taking among investors. Exchange balances have also seen a slight uptick, indicating potential selling pressure that could slow or reverse gains.

Currently, weekly active addresses on the Ronin network remain below 10,000, indicating that user growth has not yet fully recovered. Open interest in AXS futures has reached $130 million, the highest level in three years, highlighting increased speculative activity and liquidation risks. Furthermore, transaction flow data paints a mixed picture, with some investors withdrawing AXS from exchanges, suggesting bullish sentiment, while others deposit tokens onto exchanges, hinting at caution or profit-taking. These conflicting signals highlight the fragility of current market momentum despite the strong short-term rally.

Axie Infinity Price Forecast

Looking ahead, $2 represents a critical support level for Axie Infinity. Sustaining movement above this threshold could pave the way for further short-term gains. However, declining holder numbers and heightened speculative activity suggest persistence of volatility. Investors should monitor trading volumes and on-chain indicators closely to assess market sentiment. The long-term growth of Axie Infinity (AXS) will likely hinge on revitalizing user engagement and expanding its GameFi ecosystem. While this impressive rebound is notable, caution is warranted as the token navigates this critical phase.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.