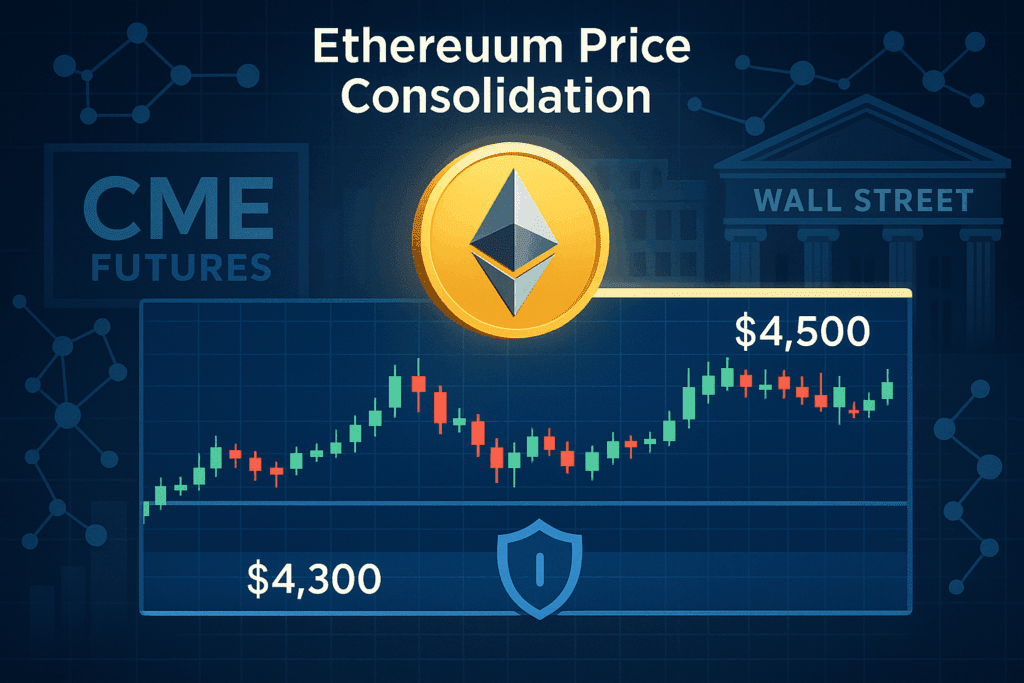

Ethereum (ETH) is currently trading within a narrow range between $4,200 and $4,500, suggesting a potential consolidation, bolstered by significant accumulation figures that reflect long-term support. Institutional interest in ETH is seeing record highs, with key resistance levels shaping the future of the cryptocurrency.

Accumulation Trends between $4,300 and $4,400

Data from blockchain analytics firm CryptoQuant highlights a crucial accumulation zone between $4,300 and $4,400. Approximately 1.7 million ETH, worth around $7.5 billion, have been absorbed into long-term accumulation addresses at these levels.

A considerable amount of this activity has been linked to withdrawals from centralized exchanges, indicating an average entry cost of nearly $4,300. This cohort of buyers establishes an important support zone that could cushion Ethereum if prices revisit lower levels.

Analysts suggest that ETH’s ability to stay above this range may determine whether the current consolidation transitions into a launchpad for a rally or heads for a deeper correction. Notably, Binance, the largest exchange worldwide by volume, has been pivotal in managing the largest capital outflows during this accumulation phase.

Interestingly, addresses depositing ETH on Binance report a significantly lower average entry cost, around $3,150. This divergence points to contrasting strategies between long-term holders accumulating at higher levels and short-term traders aiming for profits at lower entry points.

Institutional Participation and Derivatives Market Activity

Institutional inflows are also shaping the outlook for Ethereum. Open interest on the Chicago Mercantile Exchange (CME) has reached record levels, with strong short-term contract concentrations spanning one to three months.

While this concentration increases the likelihood of volatility during contract expiration, it also signals heightened institutional engagement. Notably, longer-term expirations of three to six months are also building up, which analysts interpret as a bullish sign for Ethereum’s broader trajectory.

Market analyst Pelin Ay pointed out that demand from institutions and positioning in derivatives markets could support a further rise. Despite high liquidation risks, Ay suggested that ETH might still target the $6,800 resistance level by year’s end.

Technical Levels and Market Sentiment

From a technical perspective, Ethereum has largely fluctuated between $4,200 and $4,500 in September, trailing behind peers like Bitcoin and Solana, which have recently hit higher peaks. This divergence suggests a temporary rotation of capital toward other major cryptocurrencies.

The $4,500 level stands as a crucial inflection point. A decisive breakout above this threshold could restore momentum and trigger a stronger upward movement. Conversely, downside risks remain, with identified support areas around $4,200 and an order block near $4,000 to $4,100.

Market sentiment remains mixed. Cryptocurrency trader Merlijn noted that monthly indicators are becoming increasingly constructive, particularly with a recent bullish crossover in MACD after years of consolidation. Merlijn asserted that this technical signal indicates Ethereum is “coiled and ready to explode,” adding that breaching the $4,500 mark could catalyze a parabolic rally.

As the last quarter of the year approaches, the balance between waning short-term momentum and deepening structural support may determine whether ETH breaks upward or retests pivotal demand zones.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.