AlloyX has unveiled its new tokenized money market fund, RYT, on the Polygon blockchain, which aims to integrate traditional bank-held assets with decentralized finance (DeFi). This innovative fund is a response to the growing trend that intertwines conventional finance with the decentralized ecosystem.

RYT Merges Traditional MMF Security with DeFi Flexibility

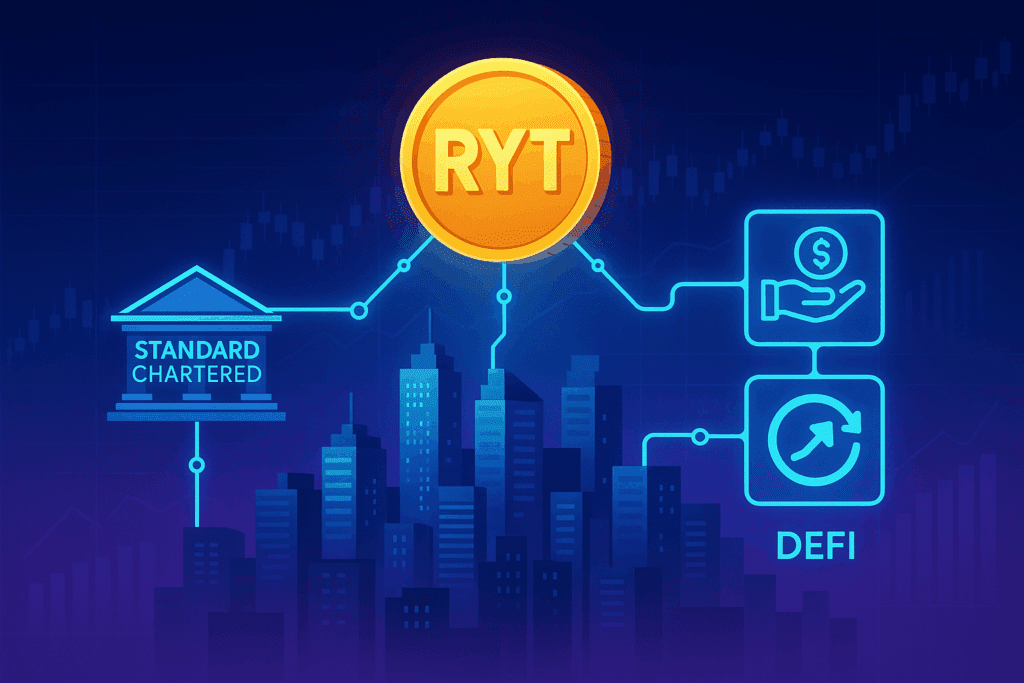

The Real Yield Token (RYT) represents shares of a conventional money market fund, with its underlying assets held securely by Standard Chartered Bank in Hong Kong. Fully regulated and subject to regular audits, the fund assures investors of its compliance and security.

In line with typical money market funds, RYT invests in low-risk, short-term instruments such as U.S. Treasury bills and commercial paper, ensuring capital preservation while generating modest returns. However, its tokenized format introduces new features.

Investors can trade RYT tokens on-chain and integrate them into various DeFi protocols, allowing them to use their tokens as collateral. Utilizing a DeFi technique known as looping, investors can borrow against their RYT tokens and reinvest the proceeds to enhance returns—a feature often unavailable in traditional money market products.

AlloyX selected Polygon for this deployment, highlighting the network’s low fees, rapid transaction speeds, and vibrant DeFi ecosystem.

Increasing Institutional Interest in Tokenized Money Market Funds

AlloyX is entering a burgeoning market. Major financial institutions are increasingly exploring tokenized money market funds, which combine the stability of cash-equivalent assets with the efficiency and composability of blockchain technology.

Notable examples include BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which provides tokenized exposure to U.S. dollar yields through Treasury bills and repurchase agreements. Similarly, Goldman Sachs and BNY Mellon have announced plans for similar tokenized MMFs, though these typically lack native DeFi features like looping or composability that set RYT apart.

According to a June report by Moody’s, tokenized short-term liquidity funds remain a “small but rapidly growing product,” with the market reaching approximately $5.7 billion since 2021. This trend underscores the increasing institutional interest in bridging traditional finance with digital markets while granting investors on-chain access to familiar low-risk instruments.

Tokenized Money Market Funds Address DeFi Cash Management Needs

The rising adoption of tokenized money market funds correlates with broader developments in the crypto ecosystem, such as the adoption of the GENIUS Act in the U.S. and the growing use of stablecoins. These factors have heightened demand for on-chain products that maintain the liquidity and security of cash-like assets.

Teresa Ho, a strategist at JPMorgan, commented to Bloomberg that tokenized MMFs present a practical alternative to posting cash or Treasury bills in DeFi protocols. “Instead of posting cash or Treasury bills, you can post shares of a money market fund and avoid losing interest along the way. This reflects the versatility of money market funds,” she stated, highlighting the appeal of products like RYT for investors seeking both yield and utility.

The launch of AlloyX marks a significant milestone for tokenized finance, showcasing the potential of traditional instruments to coexist with decentralized protocols while providing innovative ways to generate yield. As demand for real-world assets on the blockchain grows, products like RYT may become a vital bridge between conventional finance and DeFi, attracting both institutional and retail investors in search of safe, liquid, and composable on-chain assets.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.