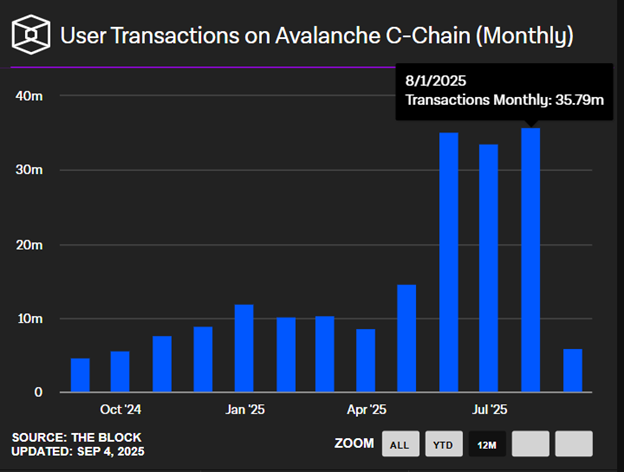

The price of Avalanche’s AVAX token is facing challenges after failing to break above the key resistance level of $26.50. Despite this, strong fundamentals are supporting its long-term growth prospects, even as short-term risks remain. In August alone, Avalanche’s C-Chain registered an impressive 35.8 million transactions, indicating robust demand.

Surging Activity on Avalanche’s C-Chain

Avalanche’s C-Chain, optimized for Ethereum-compatible smart contracts, recorded 35.79 million transactions in August, according to The Block. This figure represents the second-highest monthly total in its history and underscores a significant rebound in on-chain usage.

This surge in activity has been fueled by rising demand for decentralized financial applications (DeFi), non-fungible tokens (NFTs), and other dApps leveraging Avalanche’s infrastructure. The increasing adoption of the C-Chain not only strengthens the Avalanche ecosystem but also drives up demand for AVAX tokens, necessary for covering network fees, participating in staking, and securing validation operations. This persistent demand is a critical component of the token’s valuation, especially as traders watch for AVAX’s ability to breach significant resistance levels.

Short-Term Outlook Clouded by Technical Rejections

While the underlying fundamentals for Avalanche appear promising, the price action has faced repeated setbacks. On August 30, popular analyst Ali Martinez pointed out that AVAX experienced another rejection at the $26.50 level, with a potential support level around $16 if bearish momentum deepens.

This rejection prompted profit-taking, particularly following a 39% surge over the prior 60 days. Trading volumes have also slowed, with a 32% drop in daily turnover, signaling weakened buyer confidence.

Moreover, technical indicators such as the MACD histogram and the Relative Strength Index (RSI) have flashed warning signals, reinforcing a cautious sentiment in the market. Currently, the key battlegrounds are clearly defined: bulls need to reclaim the $25.46 level to regain short-term momentum, while a drop below $23.47 could extend the losses.

Strong Fundamentals Provide Long-Term Support

Despite short-term price volatility, Avalanche (AVAX) continues to benefit from strong institutional and ecosystem developments. Significant partnerships, including FIFA’s migration to the Avalanche infrastructure and the potential for a Grayscale AVAX product, highlight the increasing institutional visibility of the token.

The network’s multi-chain architecture, consisting of the X, P, and C chains, continues to attract validators. Additionally, increased staking participation enhances the overall security and decentralization of the protocol. For long-term investors, these metrics suggest that the fundamentals remain robust even as price actions fluctuate in the short run.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.