- Short-term holders trigger a correction by locking in gains.

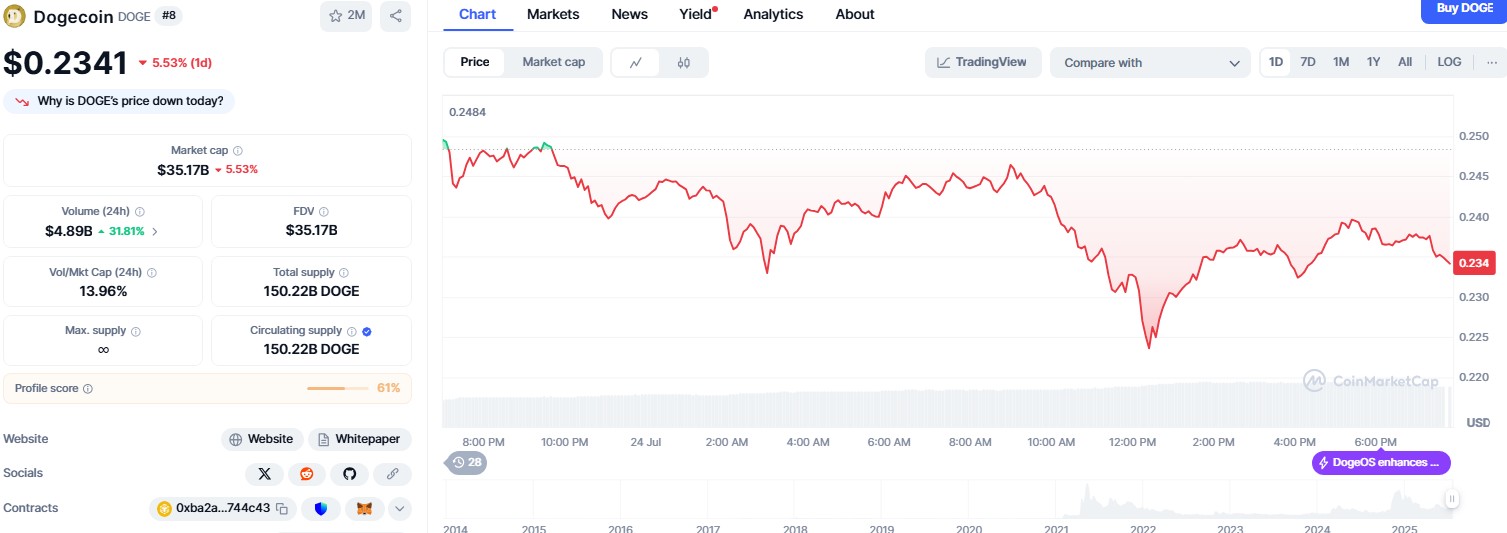

- DOGE is trading at $0.234, below a key resistance level of $0.245.

- The price could test $0.198 if the $0.220 support fails.

Dogecoin has experienced a 15% decline after reaching a six-month high earlier this month, as a wave of profit-taking among short-term holders has sparked a reversal in the recent rally of the popular memecoin.

This slowdown is part of a broader trend in the cryptocurrency market, where traders are cashing out amid uncertain macroeconomic signals and resistance at key price levels.

As of the time of this article, Dogecoin is trading at $0.234, down from its recent peaks and below the important resistance level of $0.245.

This retreat marks a significant shift in sentiment following a period of renewed optimism.

Investor Behavior Signals Short-Term Weakness

This week, the realized profit/loss ratio for Dogecoin surged to its highest level in six months. This metric tracks the profit or loss recorded by investors upon selling.

A significant rise in this indicator suggests that many holders are exiting profitable positions, indicating a waning confidence in further gains.

This wave of profit-taking has predominantly stemmed from short-term investors, who have heavily contributed to DOGE’s recent price correction.

The decision to lock in gains at current levels has exerted downward pressure on the coin’s price, suggesting a reluctance to hold amid potential short-term volatility.

Market participants are closely monitoring the support level at $0.220.

If DOGE falls below this point, it could decline further to around $0.198, a key zone observed during previous trading cycles.

Long-Term Holders Remain Steady Amid Volatility

Despite the short-term selling pressure, the long-term outlook for Dogecoin may not be entirely jeopardized.

One key indicator, “velocity,” which measures the activity of long-term holders, continues to decline.

This trend suggests that long-term holders (LTH) are not moving their DOGE, implying they are abstaining from the selling frenzy.

This reluctance to liquidate positions has historically served as a stabilizing force for Dogecoin during periods of intense market activity.

A decrease in velocity could act as a buffer, slowing the pace of the current correction and potentially preventing a complete price breakdown.

Market analysts often view the behavior of LTH as an indicator of a coin’s resilience.

Their current stance suggests that Dogecoin may still possess underlying strength, provided that support levels hold and general sentiment does not deteriorate further.

Critical Resistance Could Define Next Movements

The short-term trajectory of Dogecoin will likely depend on its ability to reclaim the $0.245 resistance level.

A breakout above this threshold could invalidate the current bearish setup and pave the way for a recovery towards $0.268.

Conversely, continued profit-taking without new buying momentum could see DOGE extend its losses.

If the support at $0.220 fails, the market could swiftly test the lower support at $0.198.

Currently, the future price action of Dogecoin will hinge on the capacity of long-term holders to provide sufficient support to offset the current selling pressure from short-term investors.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.