Dogecoin (DOGE) is showing signs of stabilization around $0.14 as the new year begins, driven by whale accumulation and rising institutional interest. A recent collaboration in Japan aims to broaden its real-world use and adoption, further stimulating demand for the cryptocurrency.

Whale Accumulation Signals Confidence

On-chain data reveals a 300% increase in significant DOGE transactions, with whales amassing 218 million DOGE (approximately $31 million) within just 12 hours. This accumulation by major holders typically indicates confidence and alleviates immediate selling pressure.

Historically, sustained whale purchases have precede short-term price increases for DOGE.

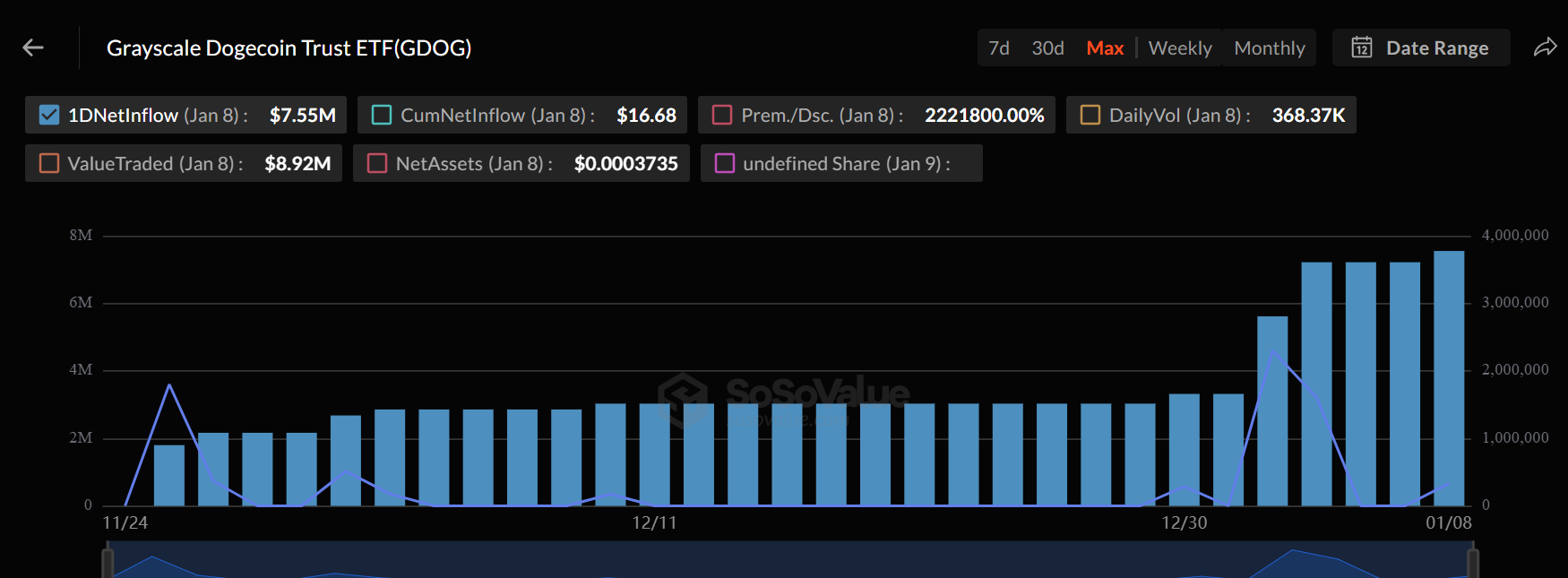

Record Inflows into Dogecoin ETF

According to SoSoValue, Grayscale’s Dogecoin Trust (GDOG) saw an inflow of $7.55 million on January 8, marking its largest single-day purchase since launch. Such inflows often reflect growing institutional interest and create structural buying pressure in the DOGE market.

Even modest institutional participation can significantly impact meme coins like Dogecoin. Ongoing inflows could help maintain support around the critical level of $0.144, enabling the 50-day moving average to establish a bullish base.

Real-World Expansion Efforts in Japan

In an announcement made Thursday, the Dogecoin Foundation, through its corporate branch, House of Doge, has partnered with abc Co., Ltd. and ReYuu Japan Inc. to explore real-world adoption of Dogecoin in Japan. This strategic collaboration focuses on regulated tokenization, payment infrastructure, and real asset solutions.

Japan is a high-adoption market for cryptocurrencies, and expanding Dogecoin’s utility beyond memes could drive long-term demand. Although no immediate product launches have been announced, these partnerships lay the groundwork for future integration with merchants and financial services.

Dogecoin Price Outlook: Key Levels to Watch

Dogecoin (DOGE) continues to trade within a sideways range between $0.1387 and $0.145, reflecting consolidation following a prolonged bearish trend since mid-2025. The 50, 100, and 200-day EMAs are acting as resistance, while momentum indicators like MACD and RSI suggest neutral to slightly bullish conditions.

Although technical indicators currently point to sideways trading, fundamental developments imply potential for upward price movement if trends in institutional and real-world adoption persist. The combination of whale accumulation, ETF inflows, and strategic partnerships in Japan creates a cautious optimism regarding DOGE’s price movements.

In the short term, a daily close above $0.145 could trigger a rally towards the $0.15 to $0.16 range, while a break below $0.14 may risk revisiting support near $0.12.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.