Three decades ago, Trip Hawkins was at the height of his career, having founded Electronic Arts and made a significant impact on the gaming industry with blockbuster titles like Madden NFL and The Sims. However, a series of financial missteps led to his downfall, transforming him from an industry icon to a cautionary tale of wealth lost. Today, as EA approaches a historic acquisition, Hawkins reflects on what could have been.

The Rise of a Gaming Visionary

Before Trip Hawkins became a renowned leader in the gaming industry, he was delving into the world of game theory at Harvard. While attending Harvard alongside notable figures like Bill Gates and Steve Ballmer, Hawkins crafted his own major in Strategy and Applied Game Theory, complemented by an MBA from Stanford. This unique educational background informed his innovative approach to the gaming business.

In 1978, Hawkins joined Apple as one of its first 50 employees. Initially serving as the Director of Strategy and Marketing, he later reported directly to Steve Jobs. During his tenure at Apple, Hawkins recognized that the company’s creative talent was largely being utilized to develop mundane software products. He believed these artistic minds should be harnessing their creativity to produce engaging games instead.

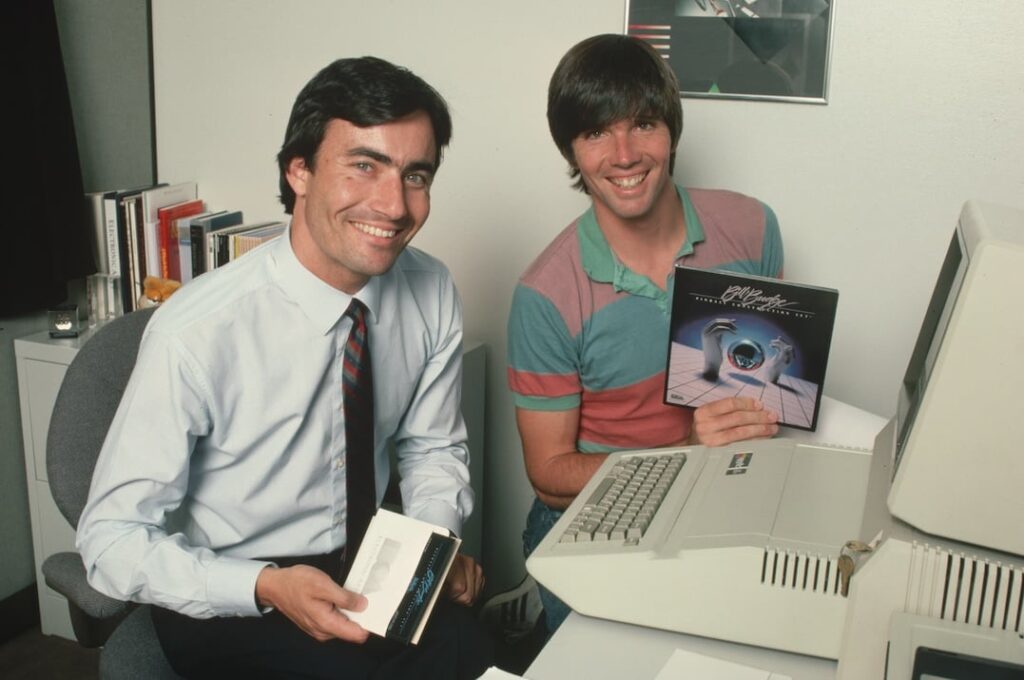

In May 1982, Hawkins took a leap of faith, investing $200,000 of his own money to establish a video game development company. Shortly after, he secured his first round of venture capital and invited Apple co-founder Steve Wozniak to join as a board member. This marked the beginning of Electronic Arts (EA), where Hawkins championed the idea of treating software developers as artists, a radical concept at the time.

Hit Games and Peak Net Worth

EA’s early successes included a groundbreaking game that featured celebrity endorsements, “1 on 1 with Dr. J & Larry Bird,” revolutionizing how games marketed themselves. Following the initial hits, EA’s trajectory soared with beloved titles such as John Madden Football, which helped cement its dominance in the gaming market.

On January 9, 1989, EA went public, generating significant capital to fuel its expansion and acquire new development studios. At that time, Hawkins owned 20% of the company’s shares, but by the end of 1996, following personal and financial upheavals, his stake had dwindled to 10%. Nonetheless, this remaining share equated to a net worth of around $100 million.

From Industry Icon to IRS Target

Between 1996 and 1998, Hawkins sold approximately $66 million in EA stock to fund a lavish lifestyle and invest in a new venture, The 3DO Company. Unfortunately, this investment faltered, leading to significant financial losses. Rather than paying taxes on his substantial capital gains, Hawkins turned to complex tax shelters suggested by accounting firm KPMG, which ultimately resulted in legal troubles with the IRS.

In 2002, the IRS disallowed his tax shelters, leaving Hawkins responsible for nearly $36 million in back taxes and penalties. Struggling to manage his financial obligations, he filed for Chapter 11 bankruptcy in 2006, attempting to negotiate his debts. However, both the IRS and California’s Franchise Tax Board pursued claims against him, alleging attempts to evade payment.

Legal Battles and Bankruptcy

Despite his assertions that he was the victim of his advisors’ questionable practices, numerous legal battles ensued over the coming years. In a pivotal 2014 ruling, the Ninth Circuit Court concluded that extravagant spending alone wasn’t enough to prove intent to evade taxes, resulting in a reassessment of Hawkins’ case.

By 2016, after a lengthy process, the bankruptcy court ruled in Hawkins’ favor, declaring that he did not intentionally evade tax obligations. Consequently, he was relieved of more than $25 million in debts, marking a notable end to a challenging chapter in his life.

Life After EA

Even after his financial strife, Trip Hawkins remained active in the tech industry, taking on roles that continued to reflect his passion for gaming and innovation. He served as a professor at UC Santa Barbara, imparting his knowledge and experiences to new generations of entrepreneurs.

Despite the losses of his earlier years, Hawkins’ influence in the gaming industry endures. His early decisions and ingenuity laid the groundwork for the modern gaming landscape, and while he navigated through bankruptcy, his story serves as a reminder of the volatile nature of success and the importance of sound financial guidance.

What Could Have Been

Ultimately, Hawkins emerged from bankruptcy, but his decisions during the late ’90s cost him the opportunity to hold onto what could have been an even greater fortune. Had he maintained his EA stake, his net worth today could have reached billions, especially with the recent announcement of a $55 billion acquisition of EA by a consortium led by Saudi Arabia’s sovereign wealth fund. If still holding onto his original shares, Hawkins could have received an $11 billion payout; even retaining a lesser stake from the mid-’90s could have resulted in a lucrative $5.5 billion windfall.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.