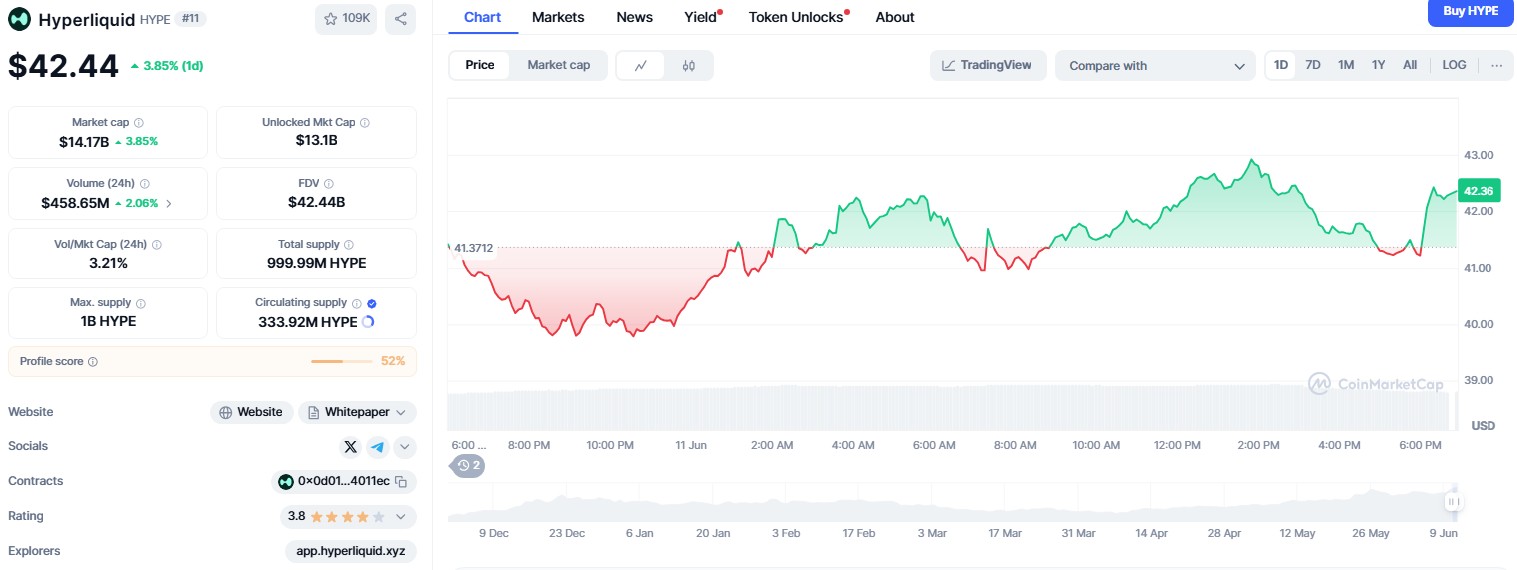

In a remarkable surge, the native token of Hyperliquid, HYPE, has surpassed $42 for the fourth time in 2025. This rise is drawing renewed attention as HYPE solidifies its status as a significant asset in the DeFi sector, marked by rising market engagement, open interest in futures contracts, and robust Layer 1 network activity.

Record Open Interest and Whale Accumulation

- The RSI is currently at 73.76, indicating short-term overbought conditions.

- Open interest in futures contracts reached an all-time high of $1.89 billion.

- Annual fees of $851 million are supporting ongoing token buybacks.

This latest price movement aligns with a trend of increasing institutional activity, whale accumulation, and the higher utilization of protocols, driving Hyperliquid’s total value locked (TVL) to $1.73 billion.

As of now, the HYPE token is testing its price dynamics, supported by a range of on-chain and technical indicators exhibiting significant bullish momentum.

The recent rise above $42 has not only sustained gains achieved since early April, when the token was priced around $9.29, but has also propelled it by over 350%. This makes HYPE a focal point for both retail and professional traders within the DeFi landscape.

On-Chain Data Signals Strong Accumulation

A series of substantial transactions involving millions in USDC and SOL highlights growing interest among high-conviction traders.

Two distinct wallets deposited $19.43 million in USDC to open long positions with 5x leverage on HYPE futures contracts.

In another major transaction, a whale used $11.8 million in SOL as collateral to borrow $4 million in USDC, later purchasing and staking 126,353 HYPE tokens at $39.10 each.

A third wallet acquired 259,367 HYPE tokens with $9.97 million in USDC, indicating that capital inflows are not only speculative but strategically targeted.

Open interest in HYPE futures has reached a record $1.89 billion, according to Coinglass, corresponding with a surge in platform fees and user activity.

Technical Indicators Reflect Bullish Strength

The HYPE/USDT chart confirms a robust parabolic movement that places the token’s momentum in overbought territory.

The relative strength index (RSI) currently stands at 73.76, suggesting that while bullish pressure dominates, short-term corrections could occur.

The MACD indicates a bullish crossover above the zero line; however, the histogram has started to flatten, signaling potential stabilization of momentum.

Another crucial measure, the BBTrend momentum indicator, remains elevated. Extended readings like this often precede price volatility or significant pullbacks, especially when parabolic price curves begin to test structural support.

The current resistance is near $44.50, and breaking above this level could trigger a new rally aiming for $50. Conversely, if the price fails to hold above $38, it may retreat to $34 or even to a critical support level of $26.89.

Hyperliquid Ecosystem Indicators Show Strong Growth

The Hyperliquid platform continues to demonstrate robust growth across various metrics.

According to DeFiLlama, the TVL is now at $1.73 billion, making it one of the most liquid Layer 1 DeFi protocols.

Data from Artemis reveals that daily fees have reached $2.99 million, even surpassing Ethereum and Solana on certain days.

With an annual revenue of $851 million—97% of which is allocated for token buybacks—the floor price for HYPE has solidified further.

The fully diluted valuation (FDV) stands at $42.05 billion, establishing HYPE as one of the most valuable DeFi assets in terms of market capitalization.

These indicators reflect a growing user base and increasing institutional confidence. With sustained open interest, high daily activity, and whale support, Hyperliquid is positioning itself as more than just a token rally; it is evolving into a major infrastructure layer within the DeFi ecosystem.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.