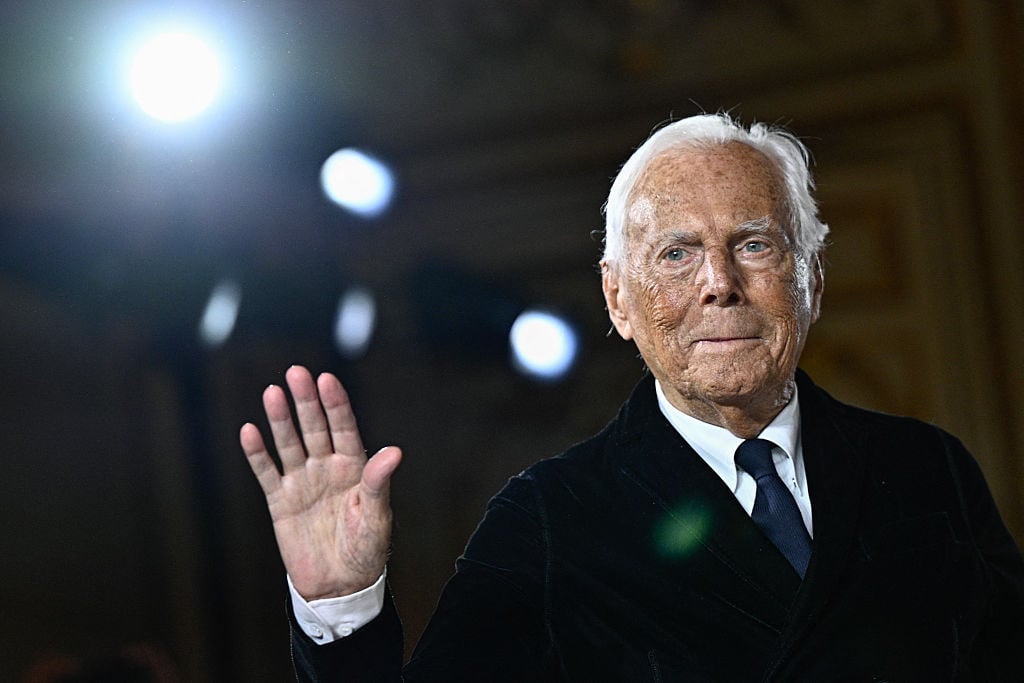

Last week, renowned fashion designer Giorgio Armani passed away at the age of 91, leaving behind a remarkable legacy. From a modest upbringing in post-war Italy to becoming the richest designer in history, Armani’s journey was defined by creativity and independence. In a surprising turn of events, his will reveals plans that could alter the fate of his iconic brand, marking the end of his long-held resistance to external ownership.

A Final Twist

Documents released following Armani’s death reveal a detailed plan within his will that signals the conclusion of his company’s fierce independence. Armani instructed his heirs to sell an initial 15% stake in Giorgio Armani S.p.A. within 18 months, followed by an additional stake ranging from 30% to 54.9% between three and five years thereafter. If potential buyers do not materialize, the heirs are directed to pursue an IPO in Milan or another prestigious global market.

In a surprising development, Armani specified preferred buyers for his brand: luxury powerhouse LVMH, cosmetics giant L’Oréal, and Italian eyewear leader EssilorLuxottica. These companies have established commercial relationships with Armani over the years, and analysts project that Giorgio Armani S.p.A. could be valued between €5 billion and €12 billion ($5.9 billion to $14 billion), positioning it as one of the most significant fashion acquisitions in recent history.

Despite this shift, Armani also devised a structure to ensure his values would remain integral to the brand. His Fondazione Giorgio Armani, along with long-time collaborator Pantaleo Dell’Orco, will hold 70% of the voting rights, with the foundation legally obligated to maintain at least 30% of the company’s capital. This arrangement aims to ensure continuity and alignment with Armani’s vision while allowing for external ownership.

The Foundation and Dell’Orco

With no children to inherit his empire, control now rests with the Fondazione Giorgio Armani, the foundation established in 2017, and his long-time business partner, Pantaleo Dell’Orco.

According to the will,:

- The Fondazione Giorgio Armani holds 30% of the voting rights.

- Dell’Orco controls 40% of the voting rights.

- Together, they command 70% of total votes, granting them decisive authority over any sale or IPO.

The foundation is mandated to retain at least 30% of the company’s capital, maintaining Armani’s principles at the core of the brand’s future. Its board will be headed by Dell’Orco and includes Armani’s nephew Andrea Camerana, banker Irving Bellotti, and two independent members. Additionally, the foundation is tasked with proposing Armani’s successor as CEO.

Thus, when discussing “Armani’s heirs,” we refer not to traditional beneficiaries, but rather to this collective: the foundation, Dell’Orco, and a close-knit circle of trusted advisors.

The Likely Buyers

The news of Armani’s planned sale has generated immediate speculation about potential buyers:

- LVMH – The luxury conglomerate owned by Bernard Arnault, which includes brands like Louis Vuitton and Dior, is viewed as the frontrunner. Arnault and Armani shared a personal friendship, and previous discussions of a partnership have occurred.

- L’Oréal – The French cosmetics leader holds a licensing agreement for Armani fragrances and cosmetics set to continue until 2050. Owning Armani outright would solidify this valuable relationship.

- EssilorLuxottica – This Italian eyewear group produces Armani glasses through a licensing arrangement that runs until 2037. Its established ties with the brand make it a logical candidate for acquisition.

While some industry analysts argue that Armani’s ready-to-wear focus may not align perfectly with LVMH’s strengths in leather goods, many expect Arnault to seize the opportunity if the brand becomes available.

Financial Context

The Armani Group reported revenues of €2.3 billion ($2.7 billion) in 2024, yet operating profits have dwindled to less than 3% of revenue, according to Berenberg. This slim margin may have contributed to Armani’s pragmatic choice to facilitate a sale.

Products like Acqua di Gio (licensed to L’Oréal) and eyewear offerings have remained resilient, but challenges persist in Armani’s core menswear sector amid evolving market trends. The luxury industry is also contending with issues such as tariffs, geopolitical tensions, and post-pandemic slowdowns.

Nevertheless, Armani remains a highly recognizable name in fashion, and analysts anticipate that this acquisition opportunity could be rare in an industry that is increasingly consolidating.

The Irony of Independence

For half a century, Armani built his identity around resisting external control. He famously rebuffed offers from Bernard Arnault in the 1980s and consistently rejected talks of an IPO. His independence was not merely a business strategy; it was who he was.

However, his will indicates a more pragmatic approach than his public persona suggested. By establishing the terms of a potential sale, he ensured the process would be orderly, favor trusted partners, and protect the foundation he established. In his final act, Armani opened the door he had long kept firmly shut.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.