The price of Maple Finance (SYRUP) has surged by 12%, driven by significant trading volume. The recent gains have seen bullish momentum converge near the key resistance level of $0.50, coinciding with a record monthly revenue achievement for the platform.

Maple Finance Price Soars 12%, Outperforming the Crypto Market

Maple Finance (SYRUP) has demonstrated noteworthy performance, with its value increasing by more than 12% in the last 24 hours, outperforming the broader cryptocurrency market, according to CoinMarketCap. This surge aligns with the platform’s historic revenue performance in October 2025, amid key recent developments within the Maple ecosystem.

Amid a generally subdued market reaction to the Federal Reserve’s recent interest rate cut of 25 basis points, prices for Bitcoin and major altcoins also reflected a similar downward trend during Asian trading hours. However, Maple Finance defied this trend by recording an impressive 12% increase, reaching highs of $0.45.

The ascent of the DeFi token has positioned it alongside other top performers such as Zcash, Euler, and Aerodrome Finance for the day, each displaying double-digit gains. As traders look to maintain price levels close to $0.42, the trading volume for SYRUP has surged to $76.4 million, up 120% in 24 hours.

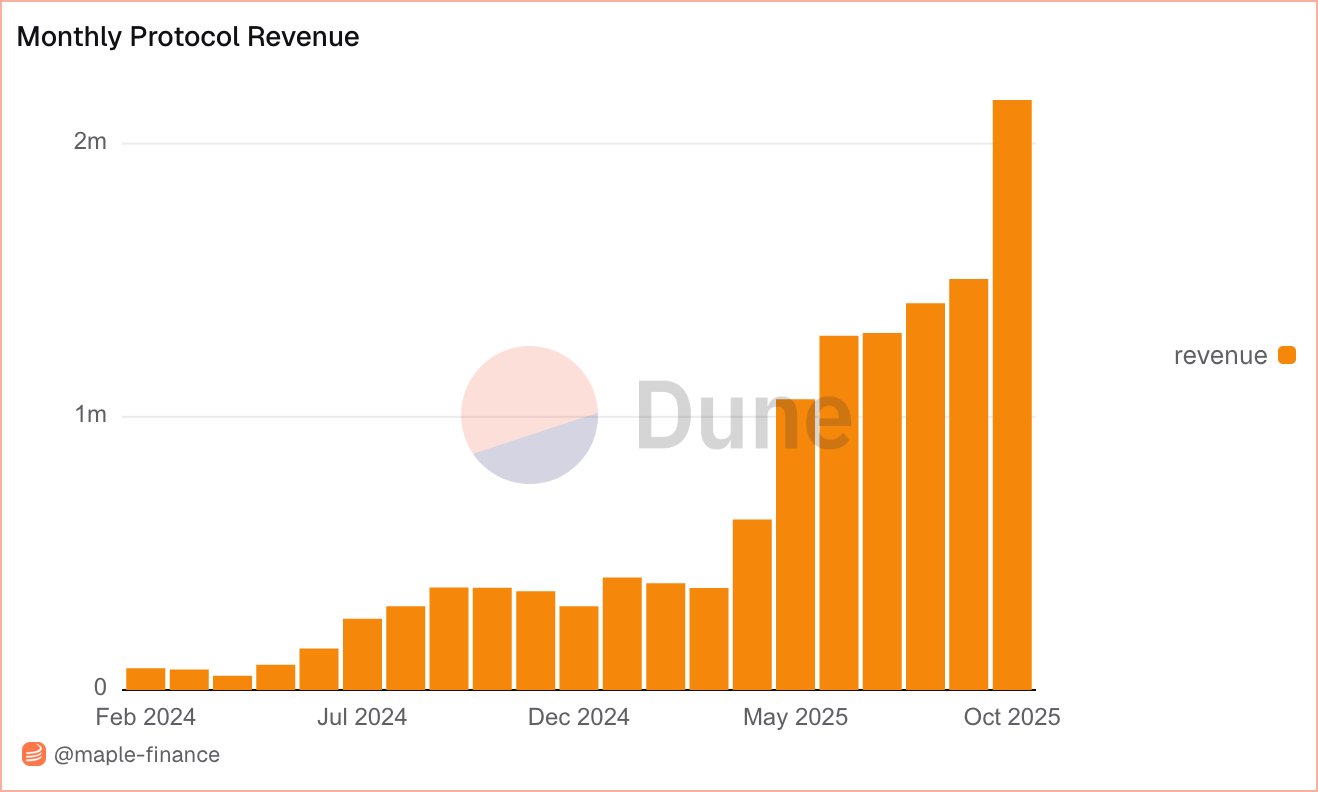

Maple Finance Achieves $2.16 Million in Monthly Protocol Revenue

As holders of SYRUP celebrate recent gains, Maple Finance has also hit a significant milestone by achieving a new record of $2.16 million in monthly protocol revenue for October 2025. This marks a substantial increase from previous months.

To contextualize this achievement, revenue figures for preceding months displayed a steady increase. The protocol’s revenue began at approximately $100,000 in early 2024, rising to around $1.2 million by mid-2025. The recent figure exceeded $2 million in October.

This revenue surge is attributed to increased lending and asset management activities directed towards institutional players seeking on-chain solutions. Protocol fees connected to these activities have significantly risen, reflecting the platform’s success in expanding its operations.

Notably, these positive developments coincide with strategic initiatives within Maple Finance, including a progressive phase-out of SYRUP staking as the protocol aims to introduce buybacks.

MIP-019: Activate the SSF and Sunset Staking

The proposal introduces three new changes aimed at extending token buybacks, expanding governance eligibility to SYRUP, and sunsetting the staking mechanism to ensure long-term sustainability.

The vote is live on Snapshot:…

— Maple (@maplefinance) October 27, 2025

Additionally, Maple has formed a partnership with Aave, a leading DeFi lending protocol, to introduce high-quality credit options. This collaboration enhances the liquidity and capital efficiency for users by listing assets like syrupUSDT on Aave’s markets.

Furthermore, Maple recently announced it has reached $5 billion in assets under management, underscoring its growing influence in on-chain investment management.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.