In a landmark achievement, Microsoft has become the second company in history to surpass a $4 trillion market capitalization, joining NVIDIA in this elite category. The tech giant’s meteoric rise over the past few years is a testament to its enduring influence in the industry and the lucrative investments made by early shareholders.

Astonishing Growth Over the Years

Microsoft’s journey has been remarkable since its initial public offering (IPO) on March 13, 1986, when it boasted a market capitalization of $780 million. In April 2019, the company crossed the $1 trillion mark, reached $2 trillion by June 2021, and soared past $3 trillion by January 2024. For those who invested wisely in Microsoft during its IPO, a $10,000 investment would now be valued at approximately $55 million.

Moreover, early Microsoft employees who received a stock package equivalent to just 0.1% of the company now find that equity worth around $4 billion. This highlights the substantial opportunities for wealth creation that Microsoft has provided over the decades.

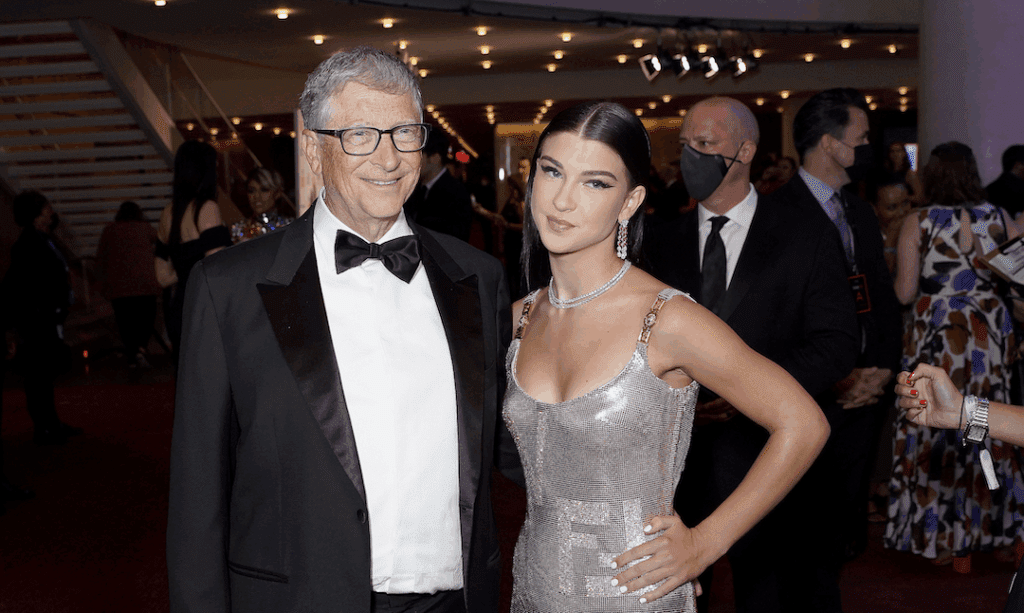

Bill Gates and the Cost of Diversification

When Microsoft went public, co-founder Bill Gates owned 45% of the company, giving him an initial paper net worth of $350 million. By 1990, after the success of Windows 3.1, his paper worth surged to an astounding $2.5 billion. However, a fateful meeting with Warren Buffett during a Fourth of July barbecue in Seattle prompted Gates to rethink his financial strategy.

Buffett, known for his investment wisdom, posed a critical question to Gates: “How are you planning to diversify your wealth?” At the time, Gates had invested everything into Microsoft, and he considered the software industry to be a volatile space harboring risks from emerging competitors. This conversation led Gates to undertake significant changes in his investment strategy, creating the private investment firm Cascade Investments.

Over time, Gates gradually sold down his Microsoft stake, reducing ownership from 45% to just 1.3% today, which is valued at around $52 billion. While this move provided financial safety, it also cost him a potentially greater fortune, given Microsoft’s current valuation.

The Cost of Hindsight

Had Gates opted to retain a larger percentage of Microsoft, perhaps 30% or 35%, his stake could now exceed $1.4 trillion, accompanied by annual dividends of about $9 billion. In contrast, fellow tech entrepreneur Larry Ellison of Oracle, who founded the company on the same day as Microsoft’s IPO, maintained a larger stake and currently boasts a net worth of $300 billion. This comparison emphasizes the substantial financial impact of Gates’s diversification decision.

Steve Ballmer: A Different Path

Steve Ballmer, another key figure at Microsoft, took a different approach. Initially, he accepted a compensation package instead of equity but later acquired 8% of the company. Today, he owns 4% of Microsoft, making him the largest individual shareholder with shares worth approximately $177 billion. Balmer’s wealth mostly stems from holding onto his Microsoft stock, reinforcing the lesson of long-term investment.

Key Takeaway

The evolution of Microsoft and Bill Gates’s financial decisions highlight an important lesson: building generational wealth often requires not just acumen but also patience. Those who invest in the right ventures and remain committed can reap significant rewards. In an age driven by complexity, sometimes the simplest advice holds the most truth: buy and hold.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.