The battle for Warner Bros. Discovery has unfolded into a significant media bidding war, captivating industry leaders and investors alike. Key players in this high-stakes contest include John Malone, David Zaslav, and the Newhouse family, all of whom stand to reap substantial rewards regardless of the outcome.

The Shifting Fortunes of Warner Bros. Discovery

For years, John Malone, David Zaslav, and the Newhouse family have formed a powerful triangle behind Warner Bros. Discovery. Malone, the company’s architect and strategic mastermind, Zaslav, the controversial CEO, and the Newhouses, the largest shareholders, have navigated the company’s ups and downs. When Warner Bros. Discovery was spun off from AT&T in 2022, its initial valuation reached nearly $60 billion. However, within just 18 months, the company’s value plummeted by almost two-thirds, compounded by mounting debt and a plummeting stock price. As the studio cut projects and postponed films amid industry strikes, Zaslav continued to earn compensation packages exceeding $40 to $50 million annually, drawing ire from shareholders. Meanwhile, Malone and the Newhouses watched the value of their stakes diminish alongside the company’s market cap.

In December 2025, however, the fortunes of Warner Bros. Discovery shifted dramatically as it became the focal point of a heated bidding war. Netflix made the first offer, agreeing to purchase the studio and its streaming assets for $72 billion, valuing the company’s shares at $27.75 each. Just three days later, Paramount Skydance countered with a stunning all-cash bid of $108 billion, offering $30 per share. This sharp rise in stock price, which had languished at approximately $11 per share just months earlier, breathed new life into the company and its stakeholders.

David Zaslav: The High-Stakes CEO

David Zaslav has been one of the highest-paid executives in the U.S. for nearly two decades, navigating a landscape fraught with turmoil, debt, and a declining share price. Since 2009, he has amassed more than $670 million in salary and bonuses. A breakdown of his annual compensation reveals:

- $11.7 million (2009)

- $42.6 million (2010)

- $152 million (2014)

- $129.4 million (2018)

- $246.6 million (2021)

- $39 million (2022)

- $50 million (2023)

In 2025, Warner Bros. Discovery’s board extended Zaslav’s contract through 2030, granting him over 23 million options that would vest immediately upon any change in company control. When the arbitrarily valued $72 billion Netflix deal was announced, these options ballooned to approximately $400 million in worth, while Paramount’s even higher bid heightened that figure to around $460 million. Additionally, the sale would trigger the accelerated vesting of around 6.3 million restricted stock units, estimated to be worth over $170 million. This brings Zaslav’s potential total payout to nearly $700 million, positioning him to become a billionaire after the deal closes.

John Malone: The Architect of Media Mergers

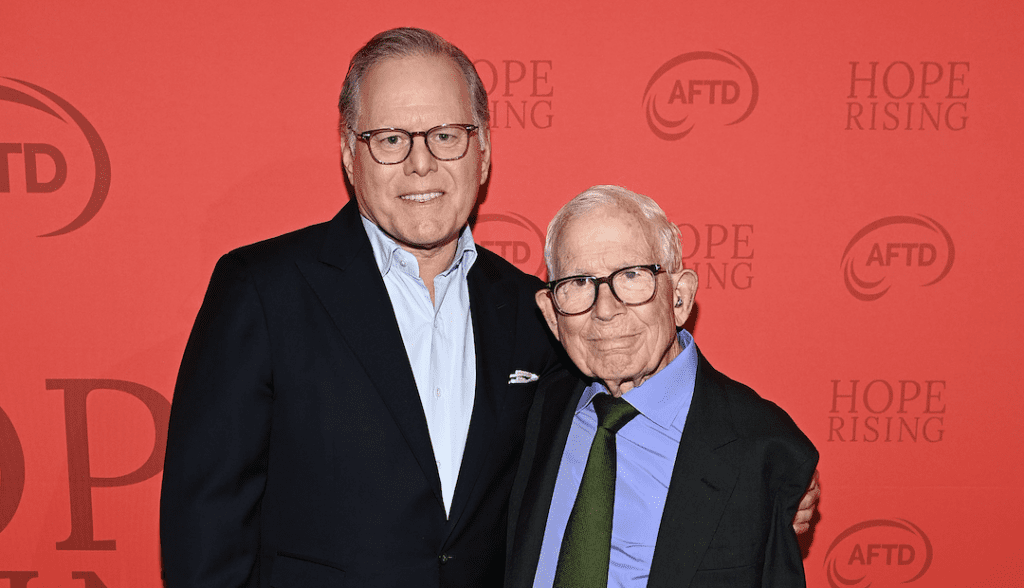

While Zaslav has emerged as the public face of Warner Bros. Discovery, John Malone has been the orchestrator behind the scenes. He has been involved in more media mergers than any other executive, including the critical Discovery-WarnerMedia merger. Although Malone’s direct stake in the company has diminished, he still holds roughly 18 million shares, which suffered significantly during the stock’s decline in 2023 and 2024.

At Warner Bros. Discovery’s peak valuation of $60 billion in 2022, Malone’s stake was worth well over a billion dollars. However, as the equity fell sharply, his holdings also lost substantial value. The recent bidding war has suddenly reversed his fortunes. With Netflix’s offer valuing shares at $27.75, Malone’s holdings are worth around $500 million, and with Paramount’s bid, that value skyrockets to approximately $540 million. Each incremental dollar added to the selling price directly boosts Malone’s bottom line by $18 million.

The Newhouse Family: A Costly Decision

The Newhouse family, spearheaded by 96-year-old Donald Newhouse, has maintained a significant stake in Warner Bros. Discovery since their early investment in Discovery Communications in the 1990s. Through Advance Publications, they became one of the largest shareholders of the newly combined entity after the merger in 2022, with over 200 million shares constituting more than 8% of WBD. This initial investment was valued at over $10 billion.

At the current offer price of $30 per share, their stake would amount to nearly $6 billion. However, the Newhouse family’s decision to sell 100 million shares in June for $10.97 per share, generating $1.1 billion, now appears to be a miscalculated move. Those sold shares would currently be valued at approximately $3 billion. Despite this, they still retain around 98 million shares worth nearly $2.94 billion today. Combined with their earlier sale, they stand to gain roughly $4 billion if the Paramount deal goes through. Nevertheless, the loss of $2 billion due to their premature sale serves as a stark reminder of the unforgiving nature of financial markets.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.