The price of ETHFI has experienced significant fluctuations amidst declining liquidity and reduced on-chain activity. With daily users of Ether.fi dropping to 328 users and protocol fees plummeting by nearly $98,000, the token faces potential deeper losses if it fails to maintain its support level at $0.96.

Altcoin Sell-off Impacts ETHFI

A broader aversion to risk across cryptocurrency markets has intensified ETHFI’s downward trajectory. As traders flee speculative tokens, ETHFI—a high-beta staking play—has underperformed its larger-cap peers. The token fell by over 7.1%, dropping to a low of $0.9997 before recovering to $1.11 at the time of publication. In contrast, larger altcoin index declines have been more modest, underscoring the project-specific pressures facing ETHFI.

Market rotation towards Bitcoin (BTC) has exacerbated outflows from smaller tokens. For instance, ETHFI’s approximately 33% decline over the last 30 days is indicative of sustained selling pressure rather than a fleeting revaluation event. Investors appear to treat the token as a leveraged gamble, quickly exiting positions amid negative macro and micro signals.

Technical Breakdown Worsens Losses

From a technical standpoint, ETHFI has slipped below the median retracement of $1.15 and tested the 0.96 Fibonacci level, marking a 61.8% retracement and nullifying a fledgling recovery attempt, fracturing market confidence. Additionally, the Relative Strength Index (RSI) nears neutral but trends downward, while the MACD histogram still reflects a bearish momentum picture, albeit with signs of a potential reversal. High trading volume during declines has illustrated strong selling conviction.

source: CoinMarketCap

source: CoinMarketCap

As algorithms and short-term traders rely on these technical thresholds, once these levels are breached, it can often accelerate downward moves, which appears to be the case here. A close below the $0.96 range would pave the way for another test of the September low at $0.80.

On-chain Indicators Paint a Grim Picture

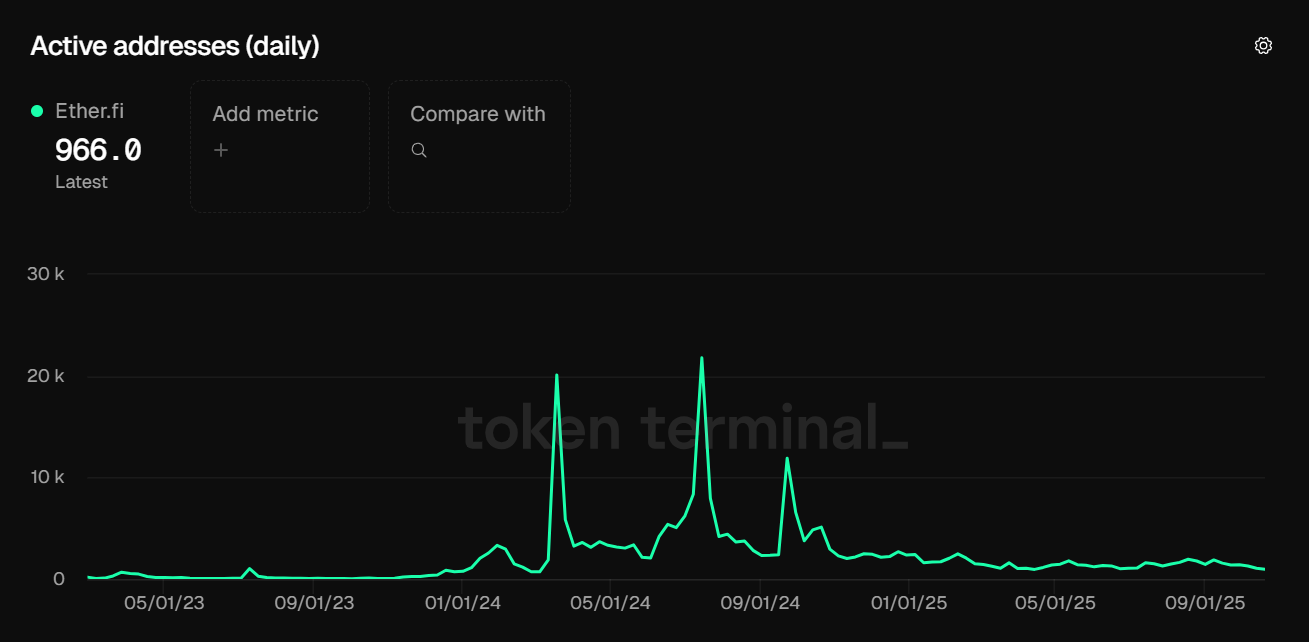

On-chain data reinforces the price weakness, with daily active addresses plummeting to 966—the lowest level since July 2025—indicating a pronounced decline in buyer and user interest.

Source: Token Terminal

Source: Token Terminal

Protocol fees have also collapsed, dropping from around $210,500 to approximately $111,700—a fall of over $98,000 that directly impacts net income for holders and diminishes the appeal of staking returns. Liquidity has dwindled to near yearly lows, with available DEX liquidity around $680,000. This thin liquidity exacerbates price movements, as even modest sell orders can drastically shift the market.

Total Value Locked (TVL) has contracted to approximately $9.784 billion, according to DefiLlama, highlighting decreasing long-term commitment to the protocol.

Tokenomics Overhang Remains Significant

Supply dynamics continue to pose a structural risk for ETHFI holders. With about 56% of the total supply in circulation, impending unlocking schedules keep potential dilution top of mind for investors. With major unlocking events approaching, fears of future supply increases may prompt preemptive sales, reminiscent of events observed in comparable projects.

Net income for holders has also tanked significantly quarter-over-quarter, with Q4 Net Holder Income (NHI) at nearly $464,000 compared to $3.9 million in Q3, signaling a substantial drop in protocol revenue which dampens incentives for accumulation or retention. Without improvements in usage or fee generation, the holder’s economic outlook remains challenging.

ETHFI Price Outlook

Short-term prospects appear bearish until clear signs of recovery emerge. Key technical support near $0.96 must hold to preserve the chance of a short-covering rally. If this level fails, ETHFI could revisit the $0.80 zone where buyers previously defended the token.

The recovery hinges on two factors: a resurgence in on-chain activity and the restoration of liquidity. An uptick in daily users and a rebound in fees would stabilize NHI and enhance the token’s narrative, while a significant liquidity recharge would reduce volatility and aid price discovery.

Until these changes materialize, traders should brace for high volatility and potential further erosion.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.