Understanding your net worth is crucial for personal financial success. Unlike your salary, which indicates income flow, net worth reveals how effectively you retain wealth. This assessment is vital whether you’re preparing for retirement, saving for a first home, or simply curious about your financial standing relative to others.

The Basics of Net Worth

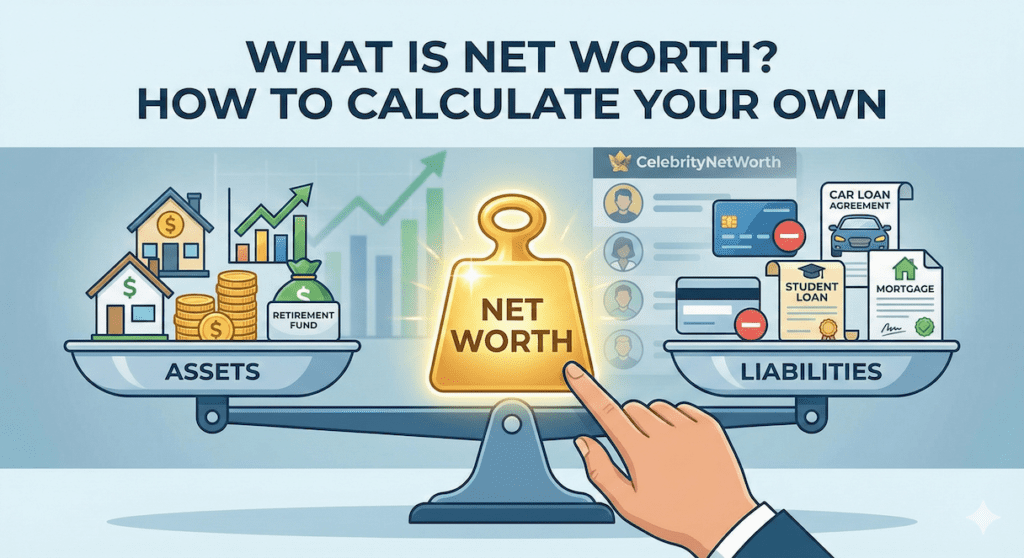

Net worth is calculated using a straightforward formula:

Total Assets − Total Liabilities = Net Worth

- Assets: Items you own that have monetary value.

- Liabilities: Debts or financial obligations owed to others.

Understanding Your Financial Picture

Assets: What You Own

Assets can be divided into two categories: “liquid” assets, which include cash or easily convertible items, and “fixed” assets, such as real estate and long-term investments.

- Cash: Balances in checking and high-yield savings accounts.

- Investments: Stocks, bonds, and brokerage accounts.

- Retirement Accounts: 401(k)s, IRAs, and other retirement plans.

- Real Estate: Your home and other properties you own.

- Personal Property: Vehicles, jewelry, art, and collectibles.

Liabilities: What You Owe

Liabilities represent claims against your assets and can hinder your net worth.

- Mortgages: Remaining balances on home or investment property loans.

- Consumer Debt: Credit card balances and personal loans.

- Student Loans: Both federal and private education debt.

- Auto Loans: Outstanding balances on vehicle loans.

A Practical Example

Consider the case of “Jane Dough.” At first glance, Jane seems financially successful with a $500,000 home and an impressive car. But what is her actual net worth?

| Jane’s Assets | Jane’s Liabilities |

|---|---|

| Primary Residence: $500,000 | Mortgage Balance: $200,000 |

| Stock Portfolio: $250,000 | Car Loan: $10,000 |

| Retirement Savings: $400,000 | Student Loans: $50,000 |

| Vehicle & Valuables: $25,000 | Credit Card Debt: $5,000 |

| Cash on Hand: $25,000 | |

| TOTAL ASSETS: $1,200,000 | TOTAL LIABILITIES: $265,000 |

Final Calculation:

$1,200,000 (Assets) − $265,000 (Liabilities) = $935,000 Net Worth

Avoid Common Mistakes

When calculating your net worth, it’s essential to stay realistic. Here are three pitfalls to avoid:

- Overvaluing Lifestyle Goods: Items like old furniture may have little resale value. Only include items with significant, verifiable worth.

- Ignoring Taxes: Retirement accounts are subject to taxes upon withdrawal. Consider reducing their value by 15-20% to account for future taxes.

- Counting Gross Home Value: Always include mortgage obligations to reflect actual equity ownership.

The Importance of Net Worth

Monitoring your net worth helps you track financial progress over time. A growing net worth signifies increasing financial freedom.

This metric has garnered attention, leading to the creation of platforms like CelebrityNetWorth that monitor the wealth of high-profile individuals, including:

- Taylor Swift

- MrBeast

- Jay-Z and Beyoncé

- Elon Musk

- Cristiano Ronaldo

- Lionel Messi

Comparing Wealth in America

The latest Federal Reserve Survey of Consumer Finances reveals a stark contrast between average and median American wealth:

- Median Net Worth: $192,900

- Average (Mean) Net Worth: $1,063,700

The average is high due to wealth concentration among billionaires, while the median offers a clearer view of typical household wealth. Jane Dough’s $935,000 net worth places her in a favorable position compared to the average American household.

Strategies for Increasing Your Net Worth

- Automate Your Investing: Set up automatic contributions to your investment accounts to encourage growth.

- Pay Down High-Interest Debt: Eliminating high-interest debt yields significant returns.

- Annual Tracking: Revisit your net worth yearly rather than daily to avoid stress from market fluctuations.

In summary: Focus on growing your assets while managing liabilities to increase your net worth over time. How does your net worth measure up to the American median?

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.