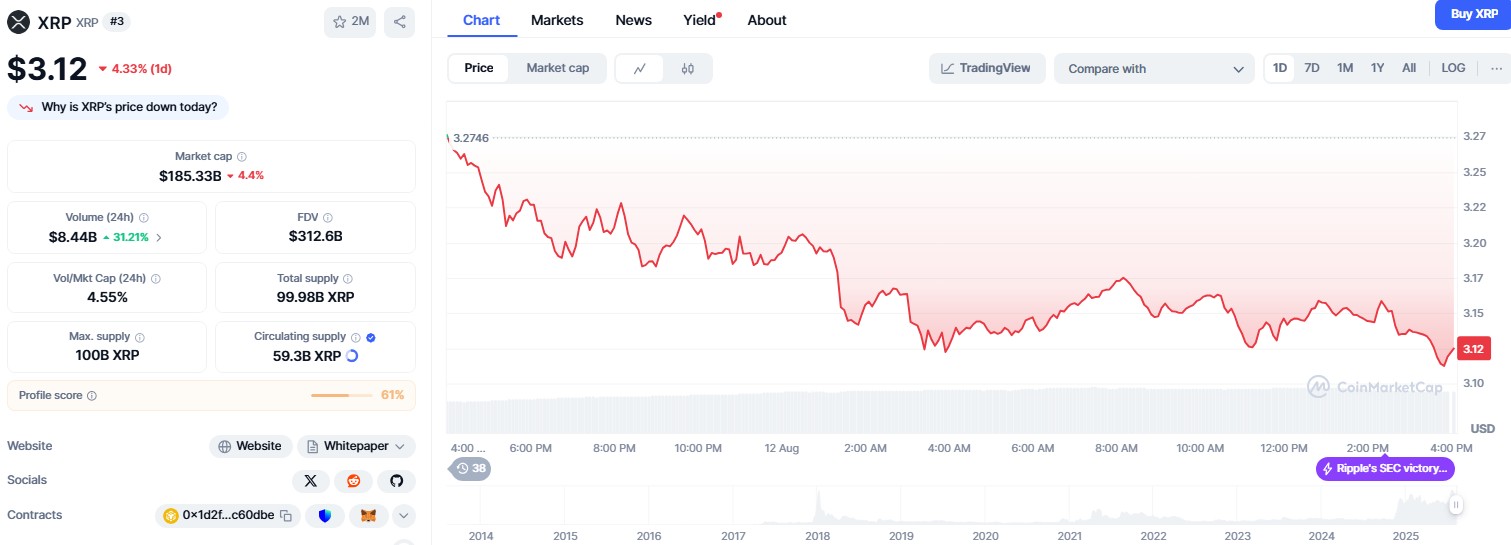

The legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) reached a conclusion last week, ending years of uncertainty regarding whether XRP should be classified as a security. While the outcome was expected to boost investor confidence, XRP instead fell by 4%, lagging behind most other major altcoins—a response that has sparked questions about market behavior and the impact of regulatory developments on token prices.

Ripple’s Legal Victory and Market Reaction

In a historic turn, the SEC concluded its prolonged case against Ripple, a lawsuit that has significantly influenced the cryptocurrency regulatory landscape in the United States. The central issue revolved around the classification of XRP as a security under federal law. The resolution was anticipated to eliminate a major source of uncertainty for Ripple and its investors.

Despite high hopes for a market rally following the announcement, XRP’s price trajectory did not align with expectations. After an initial spike in value, the cryptocurrency quickly reversed course, leading to a decline that many traders attribute to a “buy the rumor, sell the news” approach—a common strategy in the cryptocurrency space where prices often rise in anticipation of favorable outcomes, only to drop as investors realize profits.

Ripple CTO Celebrates with Humor

Ripple’s Chief Technology Officer, David Schwartz, marked the resolution of the SEC case with a light-hearted nod to Monty Python on social media. In a post featuring a GIF from the “Salad Days” sketch, Schwartz humorously reflected on the chaos that followed what was celebrated as a significant day for Ripple. His reference highlights the mixed emotions surrounding the legal outcome, a moment greeted with joy yet tempered by market realities.

SEC’s Shift Towards Clear Regulatory Framework

With the case settled, SEC Chairman Paul Atkins and Commissioner Hester Peirce expressed their commitment to crafting “clear conduct rules” for digital assets. This marks a notable shift in the SEC’s approach—from a predominantly enforcement-oriented stance to one encouraging proactive regulation. Ripple’s General Counsel, Stuart Alderoty, echoed this sentiment, advocating for clear regulatory guidelines amid long-standing calls from industry players for more coherent rules to foster innovation and attract institutional investment.

Cautious Market Sentiment

The market’s response to the SEC’s regulatory changes appears to be one of caution. Traders are opting to wait and see how new proposals translate into actionable policies before committing to long-term investments in XRP or other cryptocurrencies. The lingering sentiment of caution is underscored by observations on social media, where many traders express confusion over the price drop, especially following the resolution of the legal uncertainties that have overshadowed XRP for years.

As traders assess both macro-level regulatory news and speculative trading behaviors, XRP’s price may continue to reflect a tug-of-war between newfound optimism and underlying apprehensions until a clearer regulatory framework is established.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.