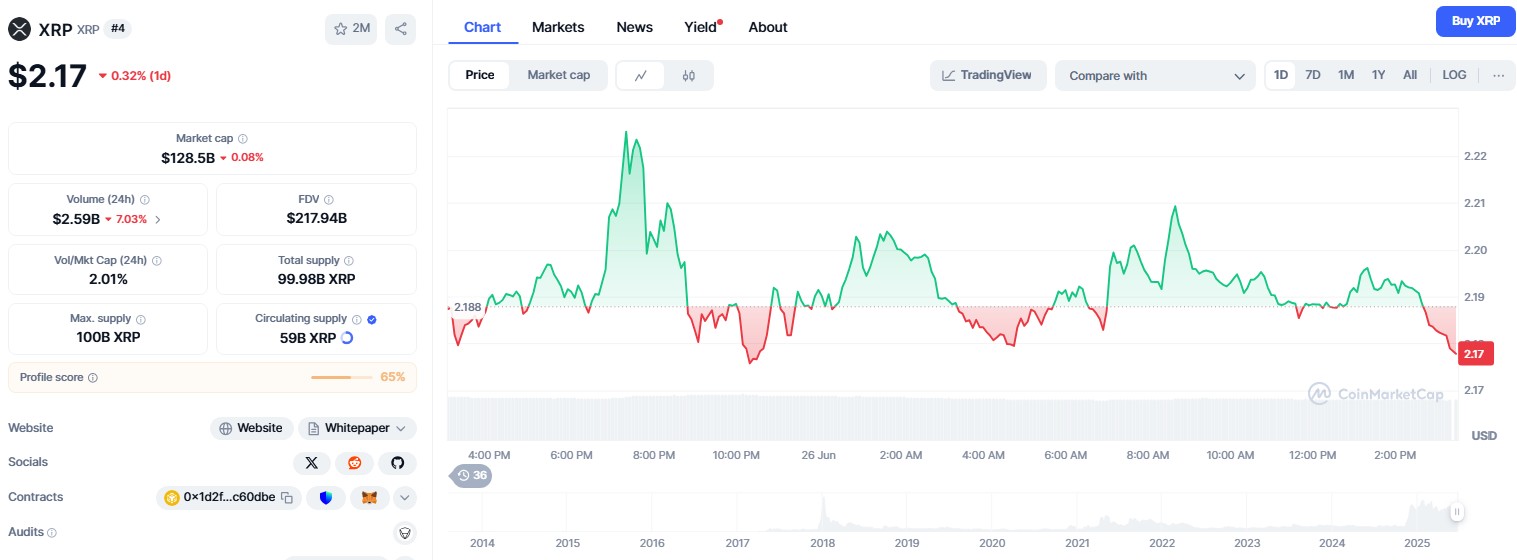

XRP’s price has remained relatively stable, trading just below $2.20, as a recent reduction in whale transactions prompts speculation about future price movement. Key technical indicators suggest potential for a breakout that could push prices toward $3.40.

Current Market Dynamics

- Whale-to-exchange transfers have dropped to zero.

- The Chaikin Money Flow (CMF) and Moving Average Convergence Divergence (MACD) show bullish momentum.

- Price could retest $3.40 or fall to $1.54 if demand declines.

Throughout the second quarter, XRP has struggled to maintain momentum, often hovering below the $3.00 mark without significant breakthroughs.

As of this article’s publication, XRP is trading at $2.17, marking a slight decline of 0.32% over the past 24 hours.

This price level continues the sideways trading pattern that XRP has exhibited since mid-April.

The prolonged consolidation reflects an overall decrease in market volatility, as investors await catalysts that may influence price action in the upcoming third quarter.

However, on-chain and technical indicators suggest that XRP may be poised for a trend reversal.

Key metrics, such as the Z MVRV score, indicate potential undervaluation, while whale sell-offs seem to have halted completely, leading to a shift in market dynamics.

If these trends continue, XRP could break free from its range-bound movement and aim for a retest of the highs reached in January.

Undervalued Status Based on Z MVRV Score

The current Z-score of XRP’s market value compared to its realized value (MVRV) stands at 2.13.

Historically, XRP has entered overbought territory when this metric is between 3.45 and 6.72.

For instance, in January, the Z-score peaked at 6.65 when the token hit $3.25, followed by a price rejection and subsequent correction.

Similarly, an unsuccessful recovery attempt in March coincided with a relatively high Z-score.

These instances contributed to the recent consolidation of the token.

However, the current reading suggests that XRP remains undervalued given market conditions, and any downward pressure from prior overvaluation may ease.

If accumulation occurs, a new rally could follow.

Whale Activity Drops to Zero Amid Halting Sales

Historically, large-scale holders, often referred to as whales, have played a significant role in driving XRP’s price movement.

Recent data from CryptoQuant reveals that whale-to-exchange transactions have plummeted to zero.

Just two days prior, there were 2,716 such transactions, indicating active selling pressure.

This drop to zero suggests that whales are no longer moving their assets to exchanges, likely opting to hold rather than sell.

This pause in selling may stabilize XRP around the $2.17 level and position the cryptocurrency for a potential upward trend.

Part of this shift in sentiment may stem from macroeconomic expectations, particularly regarding monetary policy.

As speculation grows that the Federal Reserve might cut interest rates between July and September, investors are reevaluating their exposure to riskier assets.

If borrowing costs decline, capital could flow back into the cryptocurrency market, including XRP.

Technical Indicators Support Bullish Setup

The daily price chart presents several technical signals aligning with bullish on-chain data.

The Chaikin Money Flow (CMF) has crossed above the zero line and is nearing the upper boundary of a descending wedge pattern.

A breakout from this structure could confirm the start of a new bullish trend.

Additionally, the MACD indicator has turned positive, indicating bullish momentum.

If this trend continues, XRP could surpass the resistance at $2.25 and move towards $2.69, corresponding to the 0.236 Fibonacci retracement level.

Beyond that, if sustained volume supports the rally, XRP might aim for a new test of its January peak at $3.40 before the end of the next quarter. Should momentum persist, a new all-time high could be within reach.

However, a reversal remains possible if whale activity resumes or market demand falters.

In such a scenario, XRP could dip as low as $1.54, aligning with the 0.618 Fibonacci support level.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.