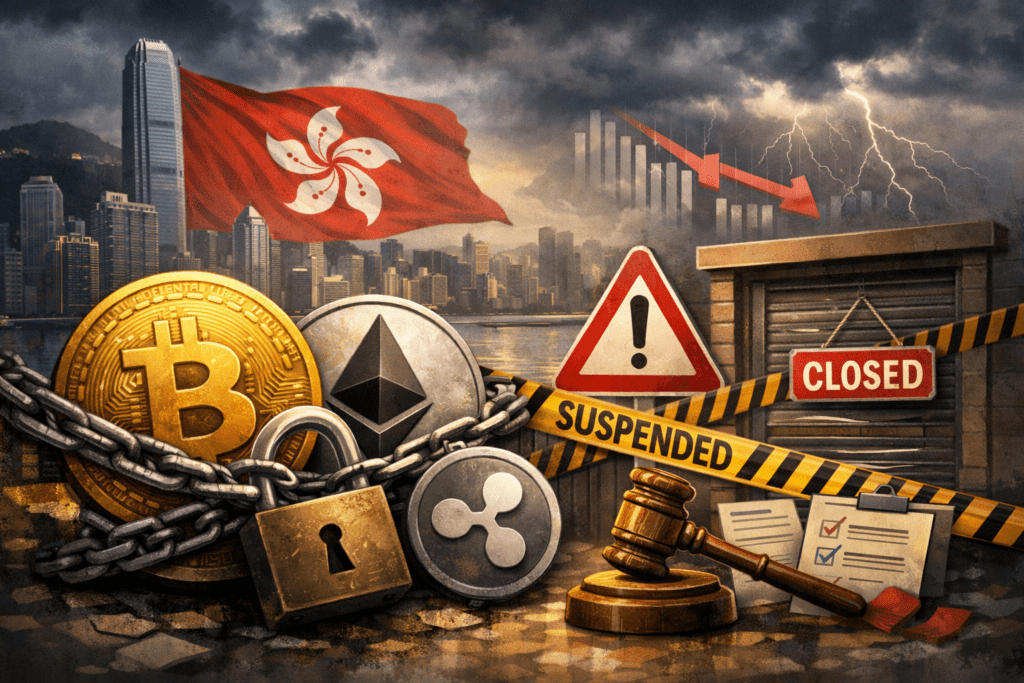

The recent move by Hong Kong to strengthen oversight of digital asset companies has raised serious concerns over the potential operational risks faced by compliant cryptocurrency firms. The Hong Kong Securities and Futures Professionals Association (HKSFPA) has warned that the implementation of new licensing requirements without a transitional period could force compliant businesses to halt their activities.

Concerns Over Tight Implementation Timeline

A primary concern highlighted by the HKSFPA is that an immediate enforcement of the new licensing framework would require all market participants to possess a valid license before the official start of the new regulations.

Without a grace period, this could lead to companies that have pending license applications being compelled to cease their regulated services, despite having submitted their requests. This situation could impact firms currently operating legally under existing rules that have not yet received a license under the new system.

Many industry observers fear that the licensing review process could be lengthy, particularly given the complexities involved, which might create regulatory bottlenecks and disrupt the sector.

Push for a Grace Period

The HKSFPA has formally requested a deliberation period of six to twelve months for businesses applying prior to the activation of the new regulatory measures. This time frame would allow operations to continue while the Securities and Futures Commission (SFC) processes applications.

Without such leeway, even companies with strong compliance practices may face forced closures due to administrative delays. The application process is often not swift, and an increase in backlog is likely as more entities prepare to enter the newly regulated environment.

Expansion of Oversight Under Review

The proposed rules are still in the consultation phase and do not have a confirmed launch date. If implemented, they would signify a substantial shift in how virtual asset services are managed in Hong Kong, expanding beyond trading platforms to include advisory and fund management services.

The industry body supports Hong Kong’s goal of enhancing regulatory standards for digital assets. However, it cautions that overly tight deadlines could deter institutional participation and slow the adoption of compliant cryptocurrency infrastructure.

Additional Concerns Regarding Implementation Risks

In a separate consultation this week, the HKSFPA also expressed worries about the upcoming Crypto Assets Reporting Framework (CARF) in accordance with OECD recommendations. While the group supports this policy direction, it reiterated that inflexible execution could result in unintentional exposure to operational and legal risks.

Collectively, these submissions convey a broader message from the industry: while regulation is welcome, its execution must avoid creating barriers that could drive firms out of the market.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.