In the world of finance, few terms evoke as much caution as “Ponzi scheme.” While Bernie Madoff remains the most infamous perpetrator, the reality is that these deceptive schemes have plagued investors for over a century. This article delves into the ten largest Ponzi schemes in history, detailing the sheer audacity behind each fraud and the human consequences that followed. Each scheme reveals the age-old promise of quick riches that ultimately ends in catastrophic loss.

The Evolution of Ponzi Schemes

The foundational strategy behind Ponzi schemes has remained largely unchanged since Charles Ponzi’s infamous scam in the 1920s. Initially, these scams promised incredibly high returns with little to no risk, appealing to affluent investors and everyday individuals alike. Over the decades, as the scale of deception increased, so did the amounts of money involved—from millions to billions, with fraudsters leveraging everything from pop culture to fake real estate to ensnare their victims.

Infamous Ponzi Schemes in History

Charles Ponzi – $15 Million

The term “Ponzi scheme” comes from Charles Ponzi himself, who in the 1920s promised investors a staggering 50% return within just 45 days. This promise was backed by nonexistent international postal coupons that he never procured. Within six months, Ponzi accrued around $15 million, but by the time authorities caught on, investors were left recovering only $5 million. He faced multiple criminal charges leading to a prolonged prison sentence, eventually dying broke in Brazil.

Lou Pearlman – $300 Million

Lou Pearlman, renowned for his role in launching iconic boy bands like The Backstreet Boys and ‘NSYNC, ran one of the longest-standing Ponzi schemes in U.S. history. Over 20 years, he misled investors by creating fictitious companies, raising more than $300 million. Convicted in 2008, Pearlman was sentenced to 25 years in prison, where he passed away in 2016.

Michael Eugene Kelly – $500 Million

Michael Eugene Kelly defrauded nearly 8,000 individuals, primarily seniors, out of $500 million through a scheme that involved misleading time-share investments. Despite his vast array of assets, he was sentenced to federal custody, earning release under house arrest due to health issues before ultimately dying in 2013.

Gerald Payne – $20 Million

Pastor Gerald Payne of Greater Ministries International deceived 18,000 unsuspecting followers, claiming they could double their investments. His methods included cashing checks just below the IRS reporting limit. Payne was sentenced to 27 years in prison, while his wife received a 13-year sentence for her role in the scam.

Scott Rothstein – $1.4 Billion

Scott Rothstein orchestrated the largest Ponzi scheme in Florida’s history, amassing $1.4 billion. Known for his lavish lifestyle and false promises of high returns on fabricated structured settlements, Rothstein pled guilty to several federal charges in 2010 and is now serving a 50-year prison sentence.

Gary Gauthier – $6 Million

Gary Gauthier, a radio host in Florida, targeted retirees by promising substantial returns on real estate investments over a five-year span. He was charged with multiple crimes, including securities fraud and racketeering, after stealing $6 million from local seniors.

Adriaan Nieuwoudt – Widespread Fraud

In 1984, South African entrepreneur Adriaan Nieuwoudt marketed a nonexistent beauty product while selling kits to investors under the guise of a home-based business. The government eventually shut his operation down as it constituted an illegal lottery.

Tom Petters – $3.65 Billion

Tom Petters became infamous for orchestrating a scheme that defrauded investors of $3.65 billion by falsely claiming to fund non-existent electronic goods. Convicted of multiple fraud charges, he is currently serving a 50-year sentence, marking one of Minnesota’s largest fraud cases.

Reed Slatkin – $592 Million

Reed Slatkin, co-founder of EarthLink, defrauded nearly 800 investors by promising exorbitant returns through an “investment club.” His scheme targeted fellow Scientologists and culminated in convictions for fraud and conspiracy.

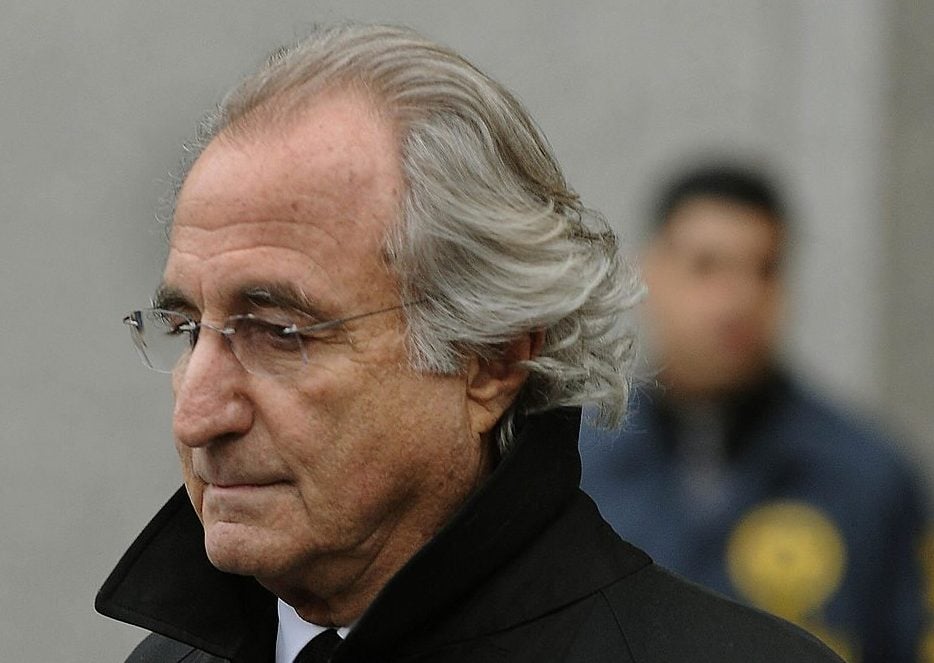

Bernie Madoff – $65 Billion

Bernie Madoff orchestrated the most extensive Ponzi scheme in U.S. history, defrauding investors of around $65 billion. Once revered in the financial community, Madoff’s empire crumbled under the weight of his greed, leading to his arrest and a 150-year prison sentence. He died in custody in 2021, leaving a legacy of devastation.

The Social Security Debate: Is it a Ponzi Scheme?

Many critics often liken the American Social Security system to a Ponzi scheme due to its structure of redistributing funds from current contributors to retirees. While concerns persist about its long-term viability, especially in light of an aging population, it is essential to clarify that Social Security is not a fraud. Unlike a Ponzi scheme, which is rooted in deception, Social Security is a legitimate social insurance program. Addressing its funding challenges will require sensible reforms, possibly including a mix of benefit adjustments and tax increases.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.