Nasdaq is calling on the U.S. Securities and Exchange Commission (SEC) to apply the same regulatory standards to digital assets as it does for traditional securities. This assertion comes from a comment letter submitted on April 25, indicating the exchange’s desire for clearer regulations in the rapidly evolving cryptocurrency landscape.

Calls for Clear Taxonomy in Digital Assets

In its letter, Nasdaq emphasized the importance of establishing a clearer taxonomy for cryptocurrencies, proposing that a specific subset of digital assets be classified as “financial securities.” The exchange argued that these tokens should continue to be regulated in the same manner as they are currently, irrespective of their tokenized format.

“Whether it takes the form of a paper share, a digital share, or a token, an instrument’s underlying nature remains the same and it should be traded and regulated in the same ways,” the letter stated. Additionally, Nasdaq suggested the creation of a classification for certain cryptocurrencies as “digital asset investment contracts,” which would fall under “light touch regulation” while still being subject to SEC oversight.

Shifting Regulatory Landscape

The SEC’s approach to cryptocurrency regulation has undergone significant changes since the onset of the Trump administration in January. Under former Chair Gary Gensler, the agency maintained that nearly all cryptocurrencies—aside from Bitcoin—constituted investment contracts and therefore fell under securities regulation.

This stance resulted in over 100 lawsuits against various crypto firms for purported violations of securities laws. However, with the appointment of Paul Atkins as chair on April 21, the SEC has adopted a narrower view on its jurisdiction regarding cryptocurrencies.

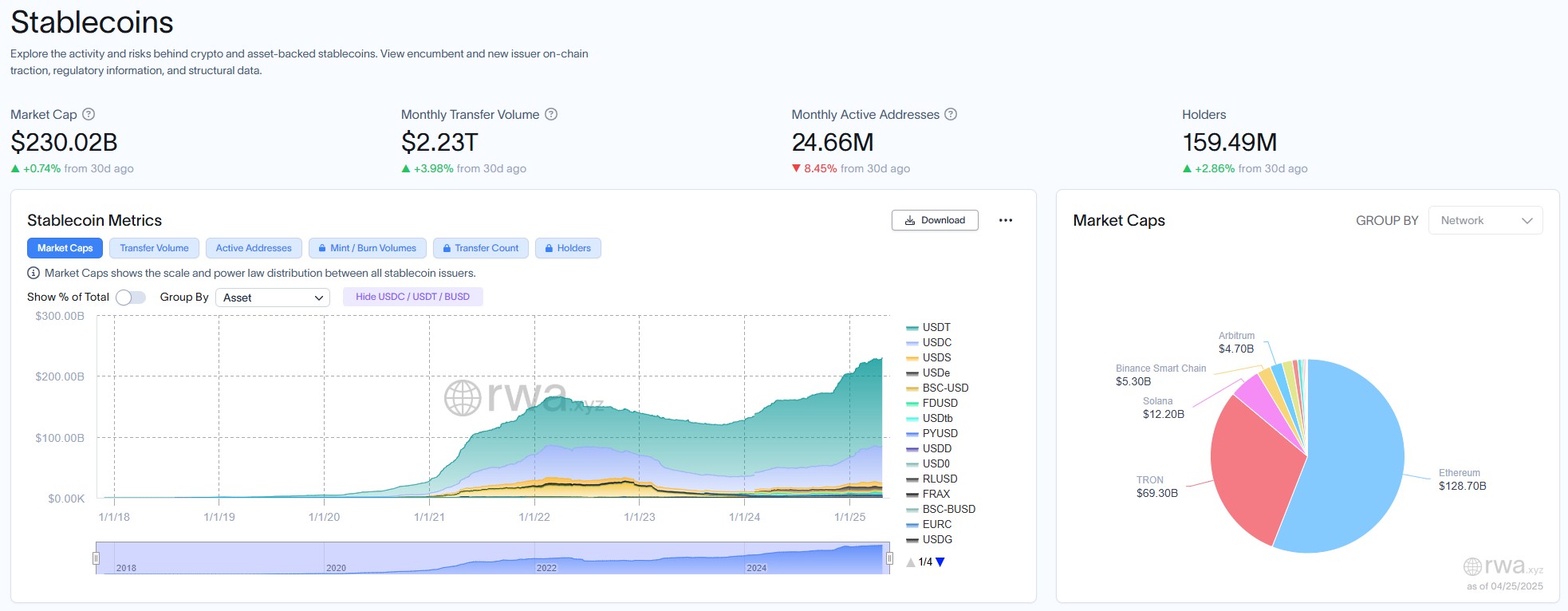

In February, the SEC clarified that memecoins, defined as clearly speculative assets without intrinsic value, do not qualify as investment contracts under U.S. law. Furthermore, in April, the agency indicated that stablecoins—digital tokens pegged to the U.S. dollar—would also not be considered securities if marketed exclusively as payment methods.

Emphasizing Integration with Traditional Finance

In its communication, Nasdaq articulated that the existing financial infrastructure is equipped to incorporate digital assets, provided that there is an appropriate taxonomy and adjustments to certain rules to accommodate the unique attributes of digital assets.

The Depository Trust & Clearing Corporation (DTCC), a private U.S. securities clearinghouse that operates under close SEC supervision, is already laying the groundwork for integrating blockchain technology within regulated financial markets. In March, the DTCC affirmed its commitment to supporting Ethereum’s ERC-3643 standard, which concerns permissioned securities tokens.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.