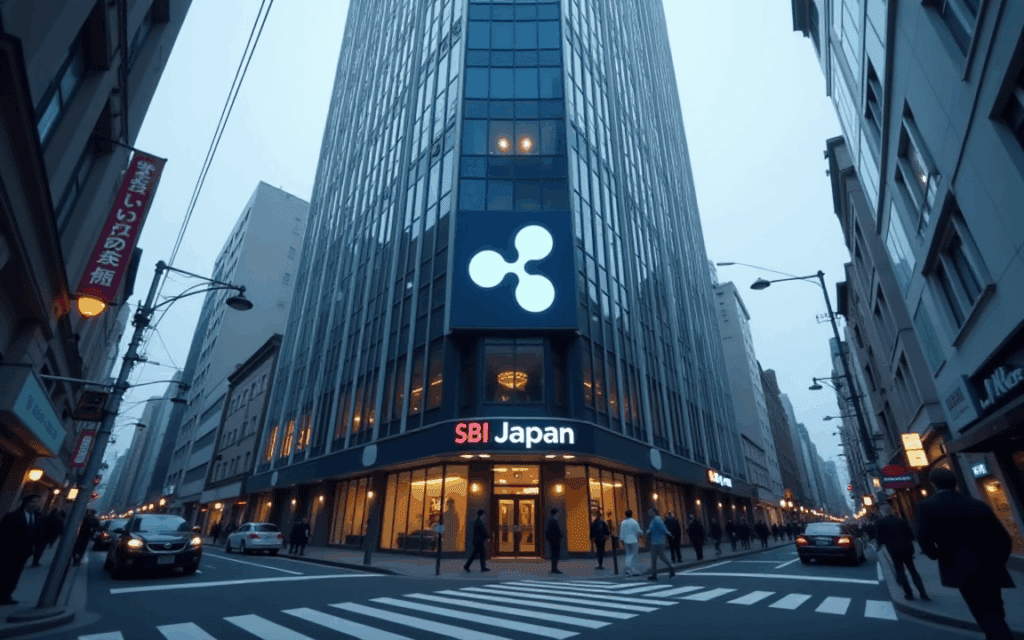

Ripple is making significant strides in the stablecoin market through a strategic partnership with Japan’s SBI Holdings. The collaboration aims to introduce the RLUSD stablecoin in Japan, marking an important move in the expanding digital currency landscape.

Strategic Partnership and Launch Plans

- A memorandum of understanding has been signed for the distribution of the stablecoin in Japan via SBI VC Trade.

- RLUSD is a licensed asset backed by US dollar deposits, reliable reserves, and government bonds.

- The stablecoin is set to debut in Japan in early 2026.

Ripple, the blockchain company, has announced a key development with its long-time partner SBI Holdings, a leading financial services conglomerate in Japan. The two firms have signed a memorandum of understanding to launch and distribute Ripple USD in Japan. They plan to utilize SBI’s certified crypto platform, SBI VC Trade Co., to make RLUSD accessible to the Japanese market. According to the official press release, RLUSD is expected to be launched in Japan in early 2026.

The $300B stablecoin market is set to grow into the trillions. Together with @sbivc_official, we’re bringing $RLUSD to Japan in early 2026, offering users and institutions a trusted, regulated and fully-backed stablecoin built for enterprise use cases.

— Ripple (@Ripple) August 22, 2025

This initiative represents a vital step toward enhancing the financial options available to institutions, retailers, and enterprises relying on legitimate digital currencies. Commenting on the integration, Tomohiko Kondo, CEO of SBI VC Trade, stated:

The introduction of RLUSD will not only expand the stablecoin options in the Japanese market but will also significantly enhance the reliability and convenience of stablecoins, fostering the convergence of finance and digital technology.

The Growing Landscape of Stablecoins

Stablecoins have thrived in 2025, especially following the approval of the highly anticipated GENIUS Act in the United States. Currently, these digital tokens boast a market capitalization approaching $300 billion, with experts predicting continued growth into the trillions.

Initial adoption of stablecoins was driven by traders seeking price stability. However, institutional demand and utility are now emerging as the catalysts for the next phase. Coinbase has recently listed L’USD1 from World Liberty Financial, which has experienced rapid growth since its launch in March 2025. RLUSD is well-positioned for this landscape, prioritizing public utility and institutional transactions.

Additionally, its compliance-focused strategy has enhanced its appeal within the industry. Ripple publishes monthly attestations from third-party auditors to ensure transparency. Ripple USD maintains unwavering stability, supported by short-term government bonds and US dollar deposits, distinguishing RLUSD from many existing stablecoins.

Jack McDonald, Vice President of Stablecoins at Ripple, emphasized that their collaboration with SBI focuses on building a compliant and trustworthy financial future, adding:

This distribution in Japan with SBI VC Trade is the culmination of our efforts. RLUSD aims to establish itself as a true industry standard, creating a reliable bridge between traditional and decentralized finance. We believe this partnership will not only increase the utility of stablecoins in Japan but also set a new benchmark for the entire market.

Future Outlook for RLUSD

The Ripple stablecoin currently boasts a market capitalization of over $666 million, with a daily trading volume of $70 million indicating notable user activity. RLUSD recently received a significant boost after Bullish confirmed its use of the stablecoin for its successful $1.15 billion IPO in the United States.

Congrats to @Bullish on a successful IPO! 👏 A portion of the IPO proceeds were settled in $RLUSD, minted on the XRP Ledger. This is the first public listing to bring the settlement process on-chain and sets a precedent for how stablecoins can shape future listings.

— Ripple (@Ripple) August 19, 2025

With RLUSD set to launch in Japan in early 2026, this success could bolster confidence in the stablecoin among institutions, businesses, and regulators across Asia.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.