Bitcoin is making headlines as it approaches its all-time high of $124,000 following a significant price surge in September and October. With institutional ETF inflows and corporate buying driving momentum, analysts predict that a price range of $160,000 to $200,000 could be attainable if demand continues to rise in the fourth quarter of 2025.

Seasonal Surge Sets In

Closing September above $114,000 marked about a 5% increase for the month, defying typical seasonal slowdowns and paving the way for October’s breakout. Historically, positive September performance has led to substantial gains in the fourth quarter—with prior years like 2015, 2016, 2023, and 2024 averaging more than a 50% rise.

This trend, coupled with an average gain of 21.8% in October and 10.8% in November, has solidified “Uptober” as a significant phrase among cryptocurrency traders. In fact, Bitcoin has already surged nearly 10% in just the first week of October, extending its yearly gains to around 27%.

With its proximity to the previous all-time high, there is a prevailing sentiment that Bitcoin may soon hit new records if demand remains high.

Institutional Demand Fuels Bitcoin Growth

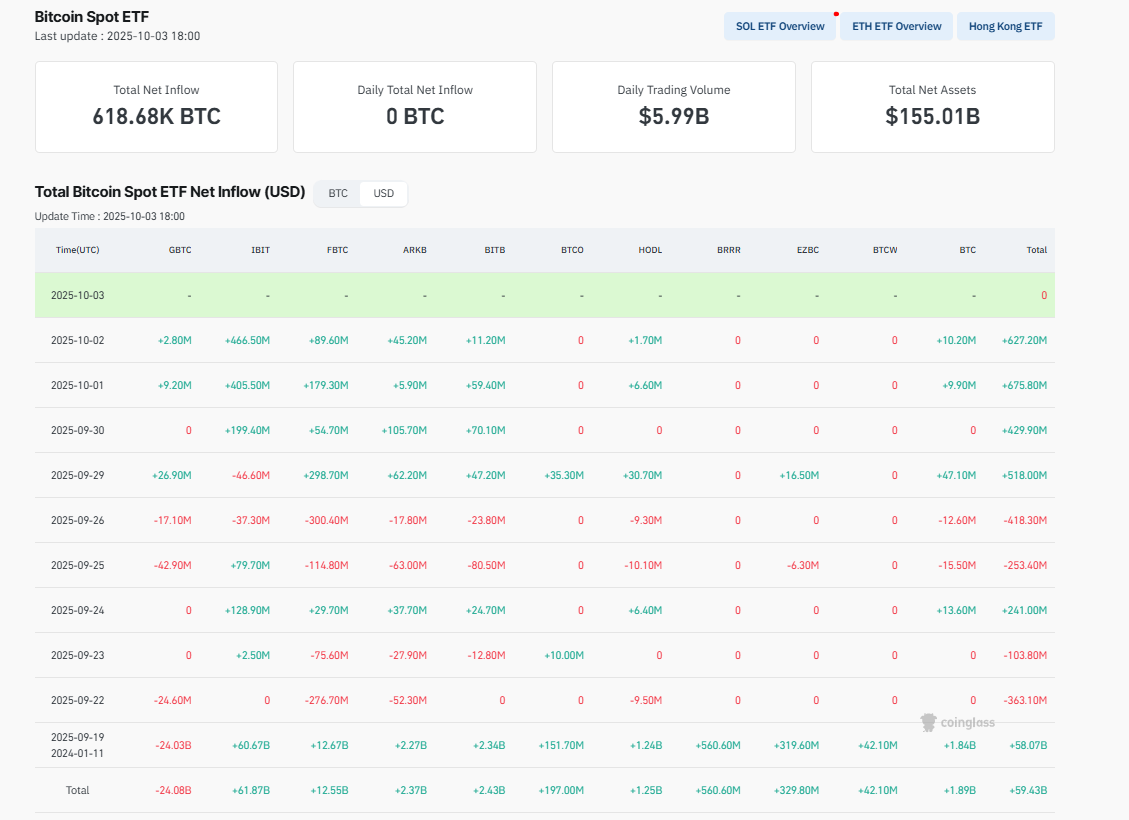

Behind this price action is a surge in institutional investment activity. U.S.-based Bitcoin spot ETFs have seen billions in inflows since early September, including over $600 million on consecutive days and a total of $2.25 billion in just the past week.

BlackRock’s IBIT ETF has emerged as a central player in this demand, with open options exceeding $38 billion, placing it ahead of Deribit, which has traditionally been the leading player in derivatives.

Companies are also contributing to this bullish trend. Strategy, formerly known as MicroStrategy, now holds 3.2% of the total Bitcoin supply after acquiring over 11,000 coins in recent weeks. This steady accumulation is tightening supply in exchanges and signaling long-term holder confidence.

This sustained buying pressure makes it challenging for the market to ignore the upward momentum.

Technical Breakout Confirms Momentum

The technical picture for Bitcoin looks equally promising. The cryptocurrency has decisively broken through the $119,500 resistance level that had capped its price until the end of September. Indicators such as the MACD and RSI are flashing bullish signals, and prices continue to trade above short-term moving averages.

Eyes are now on the $124,600 mark as the next test, with Fibonacci extensions suggesting targets between $128,000 and $130,000 in the short term. However, the larger story points to potential values beyond this: recent analyses from JPMorgan liken Bitcoin to gold, indicating a theoretical fair value of $165,000 if adoption trends converge. Citi has set a 12-month target of $181,000, while Standard Chartered has predicted that institutional flows could drive Bitcoin to $200,000 by year-end.

The CryptoQuant bullish score index hovers around 40-50, similar to levels observed before major breakouts in 2020 and 2024. The firm believes Bitcoin could reach between $160,000 and $200,000 this quarter if demand remains strong.

Additionally, the recent U.S. government shutdown has shaken confidence in traditional markets, nudging investors toward sustainable assets like Bitcoin and gold.

$200,000 in Sight

The confluence of seasonal strength, institutional inflows, technical momentum, and macroeconomic uncertainties creates unparalleled conditions for Bitcoin. As the asset hovers just below its all-time high and liquidity increases, analysts assert that $200,000 is no longer a far-fetched target but a realistic scenario if buying pressure persists through the quarter.

For now, the critical question remains whether Bitcoin can maintain closes above $120,000 and decisively surpass the $124,000 mark. If achieved, “Uptober” could become the catalyst for the most explosive rally for the world’s leading cryptocurrency to date.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.