- XRP is on the verge of breaking through as regulatory clarity and bullish momentum converge, nearing its all-time high from the 2021 cycle.

- Ripple’s push into stablecoins and EU expansion paves the way for cross-border compliance and leadership in digital finance.

- The lawsuit is nearing resolution, concluding years of regulatory uncertainty and rekindling institutional interest.

The price action of XRP approaches a critical breakout point. After hovering below its 2021 cycle peak for months, the token is showing renewed strength.

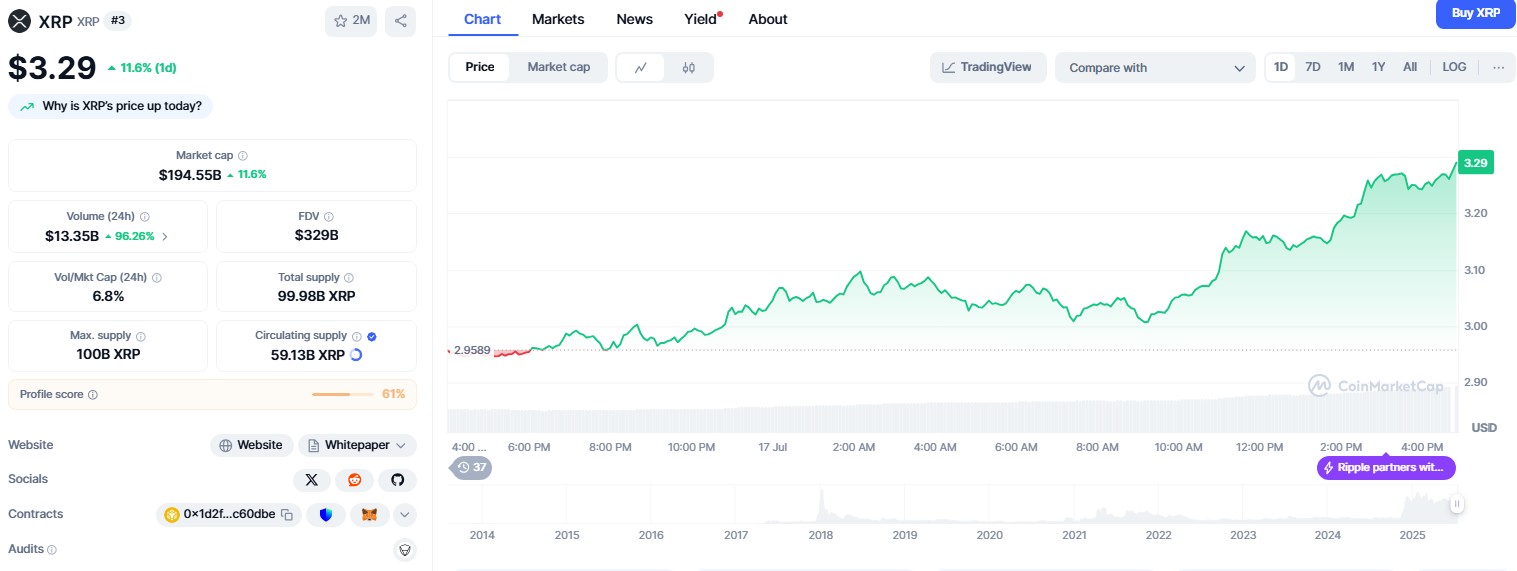

XRP is currently trading at $3.29, marking an 11.6% increase over the last 24 hours.

Trading volumes have surpassed $13 billion, and technical momentum is building across major exchanges.

This price movement reflects more than market speculation—the current XRP rally is underpinned by a host of regulatory, institutional, and technological developments that could reposition Ripple’s token at the center of digital asset adoption in both the U.S. and Europe.

Stablecoin Legislation and Ripple’s Charter Enhance Regulatory Clarity

This week, the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins) was passed by the House of Representatives after receiving Senate approval in June.

Supported by former President Donald Trump and House Majority Leader Steve Scalise, the bill coincides with the introduction of CLARITY and anti-CBDC legislation.

Ripple, which launched its dollar-pegged stablecoin RLUSD last December, applied for a U.S. national banking charter and a master account with the Federal Reserve on July 2.

These measures would allow Ripple to hold RLUSD reserves directly with the Fed, enhancing transparency and regulatory compliance.

Simultaneously, Ripple is preparing to extend its operations in Europe by requesting an EU electronic money institution license under the Markets in Crypto-Assets (MiCA) framework.

Ripple’s stated goal is to comply with MiCA standards and broaden its presence in the European stablecoin market.

Together, these developments pave the way for regulatory legitimacy in key jurisdictions, significantly strengthening XRP’s long-term position.

Ripple’s Lawsuit Nears Resolution with a $125 Million Penalty

A crucial driver of XRP’s momentum is the near resolution of Ripple’s long-standing legal battle with the U.S. Securities and Exchange Commission (SEC).

On June 26, Judge Analisa Torres dismissed a joint request from Ripple and the SEC to reduce a civil penalty from $125 million to $50 million and eliminate the permanent injunction.

The judge ruled that the parties failed to demonstrate the “exceptional circumstances” required to revise her judgment.

However, the following day, Ripple CEO Brad Garlinghouse announced on X that the company would drop its cross-appeal, expressing optimism that the SEC would do the same.

Though the $125 million penalty remains in effect, this development has been interpreted as the beginning of the end for the litigation.

The regulatory overhang that has constrained XRP for years may finally be lifting.

ETFs and Acquisitions Signal a Resurgence of Institutional Momentum

With legal uncertainties easing, fund managers are acting swiftly. On July 15, ProShares launched leveraged futures funds for Solana and XRP, while spot ETFs await SEC approval.

A week prior, the SEC released new disclosure guidelines aimed at speeding up the approval of crypto ETFs.

Trump Media & Technology Group went a step further by filing for a top-tier basket ETF including Bitcoin, Ethereum, Solana, and XRP, indicating bipartisan pressure to expedite ETF listings.

Meanwhile, Ripple is actively expanding its infrastructure.

The company acquired brokerage firm Hidden Road for $1.25 billion and is developing a lending protocol set to launch in the third quarter.

Ripple’s Chief Technology Officer, David Schwartz, stated in late June that multiple acquisitions are underway.

These initiatives aim to deepen XRP’s liquidity, strengthen its use cases, and boost investor confidence.

Price Trajectory and Technical Signals

According to crypto strategist Pentoshi, XRP has traded within a “very clean” structure over the past seven months, with overall limited resistance.

“There is arguably little resistance from here as it has not spent time trading at this point on price discovery,” he wrote on X. Relative Strength Index (RSI) readings on major trading platforms have returned to the buy territory, reinforcing bullish sentiment.

As of this writing, XRP trades at $3.29. Although it has yet to surpass its historical peak of $3.84 set in January 2018, the convergence of regulatory clarity, interest in ETFs, and Ripple’s strategic positioning marks a pivotal phase.

The coming weeks could determine whether XRP can reclaim its previous high and establish new price territory in this cycle.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.