Bitcoin Exchange-Traded Funds (ETFs) in the United States have witnessed significant outflows, totaling $1.2 billion amidst a notable drop in Bitcoin prices over the past week. Despite this downturn, interest in cryptocurrency products shows signs of growth among investors, according to industry analysts.

Significant Outflows Hit Bitcoin ETFs

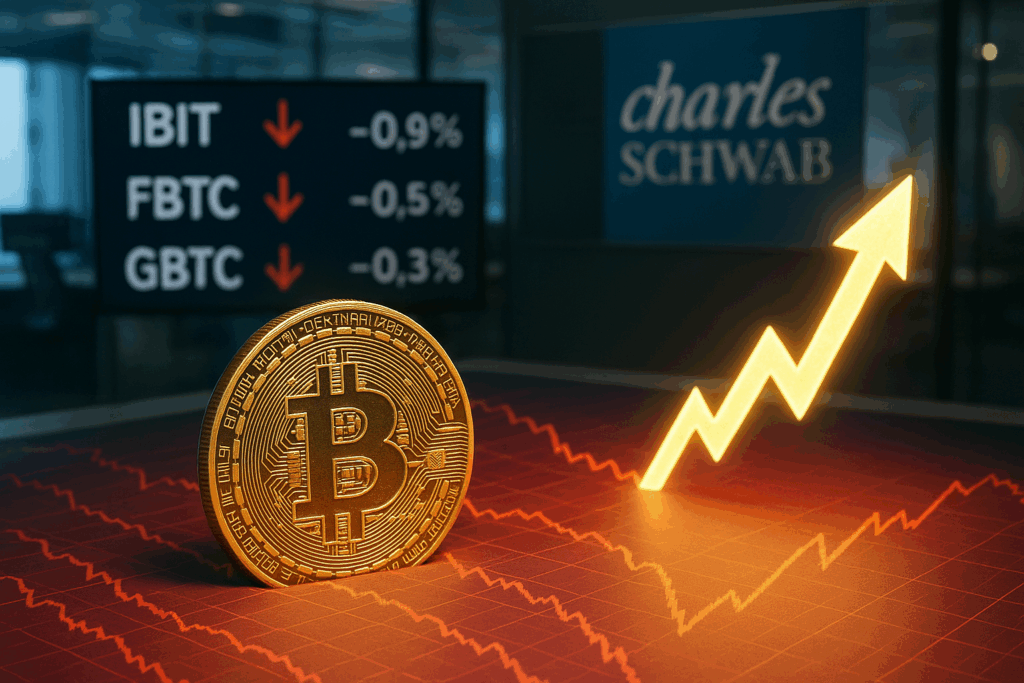

Recent data from SoSoValue indicates that the eleven Bitcoin spot ETFs listed in the U.S. recorded collective outflows of $366.6 million on Friday, culminating a challenging week for these financial products and the broader cryptocurrency market.

The most substantial withdrawal was from BlackRock’s iShares Bitcoin Trust (IBIT), which saw a staggering $268.6 million leave in just a single day. Fidelity’s Wise Origin Bitcoin Fund (FBTC) also faced significant redemptions amounting to $67.2 million, while Grayscale’s Bitcoin Trust (GBTC) experienced outflows totaling $25 million. The Valkyrie Bitcoin ETF reported lesser withdrawals, with the remaining funds showing no activity on Friday.

Overall, Bitcoin ETFs in the U.S. recorded outflows of $1.22 billion last week, with only Tuesday recording minor inflows. This downturn aligns with a sharp decline in Bitcoin prices, which plummeted from over $115,000 on Monday to just under $104,000 by Friday, marking a four-month low. This substantial drop highlights the sensitivity of institutional products to Bitcoin price fluctuations, as ETF investors appear to be retreating amid increasing market uncertainty.

Charles Schwab Reports Increased Interest in Crypto Products

While ETF redemptions suggest a cooling sentiment among some investors, Charles Schwab maintains an optimistic outlook regarding the long-term potential of cryptocurrency investment products. Speaking on CNBC, CEO Rick Wurster revealed that Schwab clients currently hold 20% of all crypto Exchange-Traded Products (ETPs) in the U.S.

Wurster noted a significant rise in interest towards cryptocurrencies over the past year, with visits to the firm’s cryptocurrency-related web pages increasing by 90%. “Crypto ETPs have been quite active,” he stated, emphasizing sustained investor engagement.

Nate Geraci, an ETF analyst, remarked that Schwab’s major brokerage platform positions it well to capture future demand. The company is already offering crypto ETFs and Bitcoin futures, with plans to launch trading for cryptocurrencies by 2026, signifying a long-term commitment to the sector despite short-term volatility.

Bitcoin Faces a Rare Slowdown in October

Typically one of Bitcoin’s strongest months, October has thus far yielded disappointing results. Data from CoinGlass reveals that Bitcoin has historically gained in ten of the previous twelve Octobers; however, this year, the asset has dropped by 6% since the onset of the month.

Despite the decrease, some market analysts remain hopeful that the “Uptober” trend may rebound in the latter half of the month. Many consider the potential for a Federal Reserve rate cut later this year as a possible catalyst for renewed demand for risk assets, including Bitcoin.

At present, however, the combination of ETF outflows, price pressures, and macroeconomic uncertainty has heavily impacted cryptocurrency sentiment, leaving investors to watch closely if the coming weeks can reverse October’s early downturn.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.