Key Points

- ETH has remained above $3,300 despite a loss of less than 1% in value.

- The leading altcoin may experience a short-term increase amid rising institutional demand.

ETH Maintains Position Above $3,300 Despite Market Decline

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has seen a minor decline of less than 1% over the last 24 hours, trading above $3,300 per coin.

This resilience occurs in the context of increasing institutional demand for Ethereum-related products. Data from SoSoValue indicates sustained interest in funds linked to Ether, with ether spot ETFs recording $175 million in net inflows on Wednesday, led by BlackRock’s ETHA and Grayscale products. This marks a gradual recovery in inflows following a quiet December.

The recent market downturn is largely attributed to the U.S. Senate Banking Committee’s (SBC) resistance to discussing crypto market structure legislation, after Coinbase retracted its support for the latest draft.

Committee Chair Tim Scott stated in an official announcement that bipartisan leaders, along with crypto and financial sectors, continue to collaborate on the bill.

This postponement follows an unexpected objection from Coinbase CEO Brian Armstrong, who emphasized that it is better to avoid passing a flawed bill than to proceed with one.

Armstrong pointed out several issues with the proposed legislation, including the removal of incentives for stablecoins, undermining the authority of the Commodity Futures Trading Commission (CFTC), enforcement of DeFi bans that infringe on privacy rights, and a de facto ban on tokenized stocks.

ETH Aims for Breakthrough at $3,500

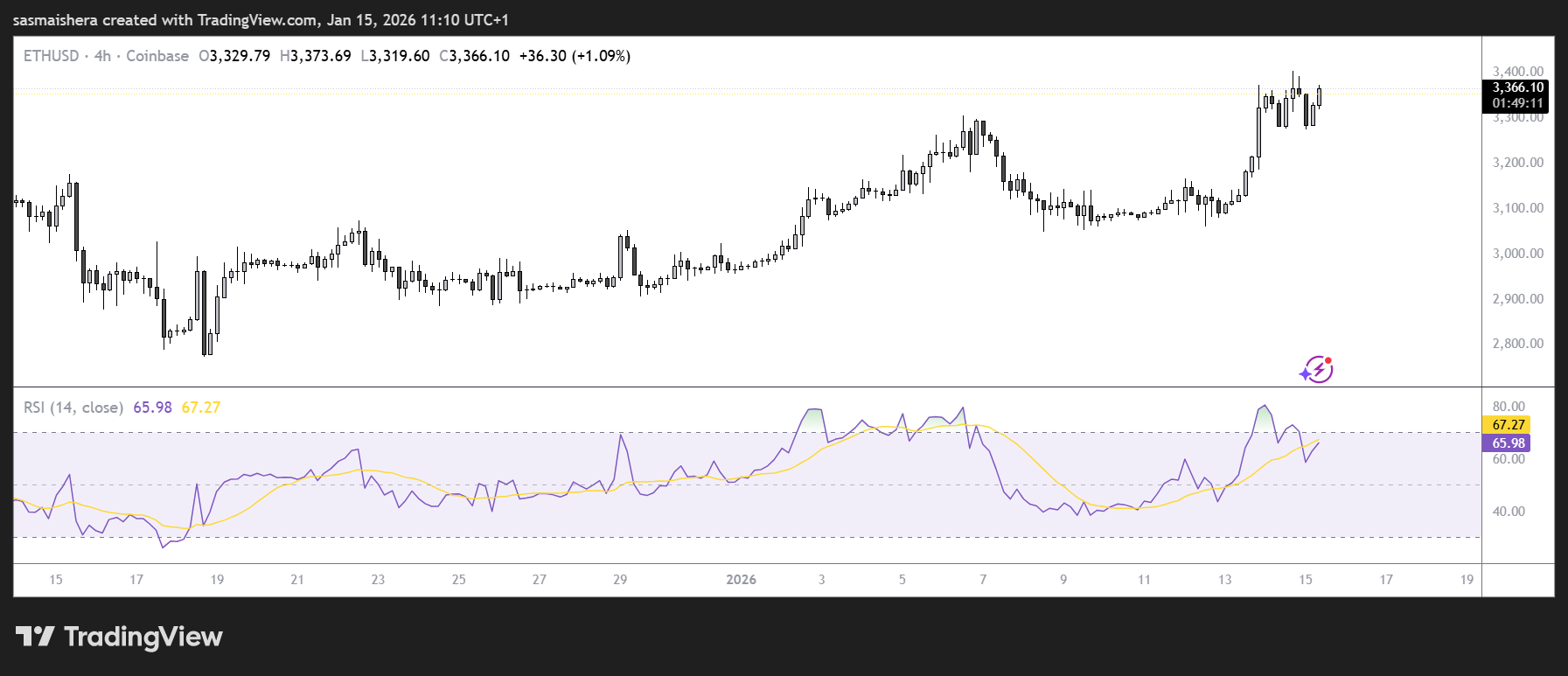

The ETH/USD four-hour chart remains bullish despite the current market pullback. ETH is trading above $3,300 as bulls defend the support level of $3,288.

The MACD indicator on the four-hour chart remains above the signal line, with green histogram bars above the zero line, supporting the bullish thesis.

The RSI at 67 indicates that buyers maintain control, as bulls push through the immediate resistance level of the 200-day EMA at $3,339. A daily close above this level could see ETH surge towards the resistance zone at $3,447, tested on December 10.

However, failing to surpass this resistance level could lead ETH back to the psychological zone of $3,000.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.