As Ethereum’s price trends upward, analysts are optimistic about its potential rise, fueled by strong institutional interest and a rumored strategic reserve by Jack Ma. Key market levels, including support at $4,400 and resistance at $4,800, are critical for investors to monitor.

Institutional Accumulation Drives Momentum

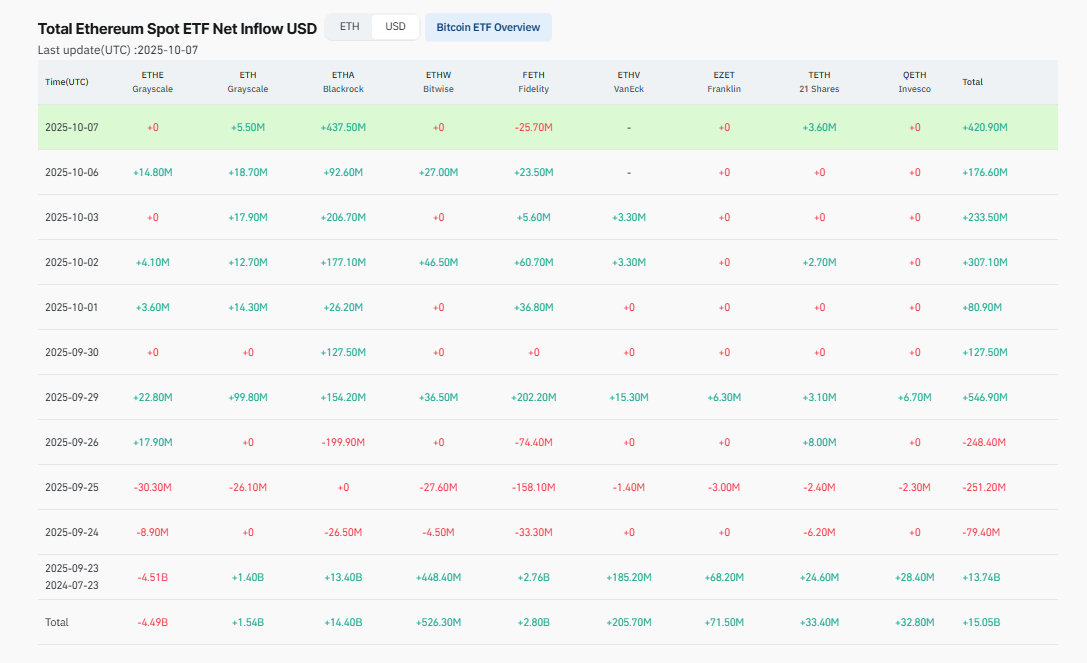

On October 7, Ethereum spot ETFs in the U.S. witnessed an impressive $420.9 million influx, marking the seventh consecutive day of positive inflows. This significant capital influx not only enhances liquidity but also signals a growing institutional confidence, setting the stage for a possible mid-term rebound towards the $4,900 to $5,000 range.

Source: Coinglass

Source: Coinglass

Moreover, this sustained demand coincides with a reduction in exchange reserves, which have dipped to a three-year low of 17.4 million ETH. Treasury bonds and the EIP-1559 burn mechanism further draw down the supply, creating favorable conditions for a potential price surge.

Technical Patterns Suggest Potential ETH Price Breakout

The Ethereum price movements in recent weeks reflect a mix of consolidation with cautious upward pressure. Currently trading near $4,450, short-term support remains around $4,400 to $4,420. Notably, an ascending triangle has been forming since June, with a rising support level and a horizontal ceiling near $4,750 to $4,800.

Source: CoinMarketCap

Source: CoinMarketCap

This pattern suggests that ETH may be poised for a breakout if bulls can reclaim the $4,800 level, paving the way towards the psychological milestone of $5,000. Despite volatility, the Relative Strength Index (RSI) currently hovers around 54, indicating a balanced market ready for momentum.

Jack Ma’s Ethereum Reserve Boosts Market Sentiment

Although details remain unverified, reports of Jack Ma building a strategic reserve of Ethereum have sparked optimism, particularly in Asian markets where ETH adoption and staking activity are robust. This accumulation has rekindled interest among both retail and institutional investors, reinforcing the bullish narrative further enhanced by ongoing ETF inflows and diminishing exchange balances.

Jack Ma is building a strategic Ethereum reserve.

I’m definitely not selling. pic.twitter.com/mq2THUv0xA

— Crypto Rover (@rovercrc) October 7, 2025

Key Ethereum Price Levels to Watch

The recent correction of Ethereum from $4,800 to approximately $4,450 highlights market volatility. An analysis of the hourly chart indicates resistance near $4,600 and critical support levels between $4,400 and $4,420. If ETH fails to maintain support at $4,400, a further decline towards $4,320 or even $4,150 could occur.

However, analysts argue that these dips appear more like momentum resets than trend reversals, especially as Bitcoin faces a similar retest following its new all-time high above $126,000. Some economists predict Bitcoin could reach $140,000 by the end of October, which may positively influence the overall cryptocurrency market sentiment, thus bolstering Ethereum’s price outlook.

Should Ethereum sustain its price above $4,400, bullish investors could regain control and drive the token towards significant targets near $4,950 to $5,050.

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.