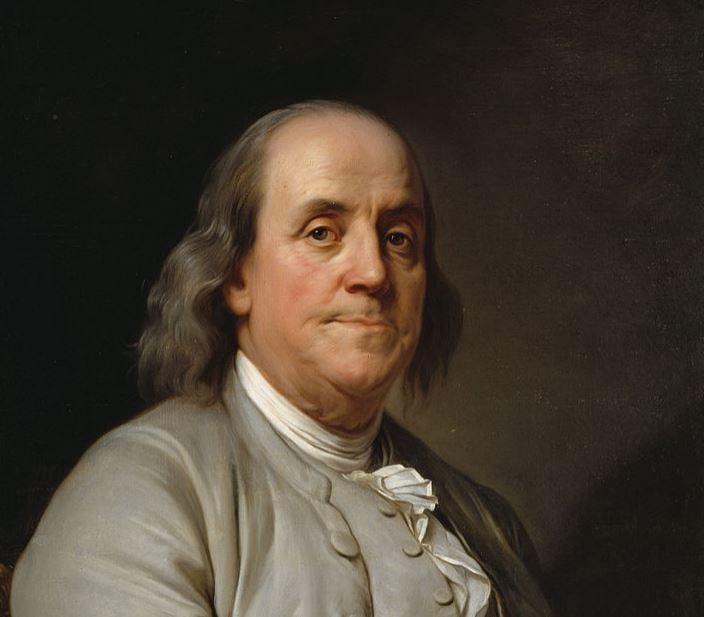

Benjamin Franklin, celebrated as one of America’s founding fathers, left an indelible mark on the nation. His legacy extends beyond just history; it influences modern financial systems and philanthropic practices. Despite never serving as President, Franklin’s impact is profoundly felt, particularly in the realm of finance. This article delves into his financial genius, particularly through his posthumous trust funds for Boston and Philadelphia.

From Apprentice to Icon

Born in Boston in 1706 as the 15th child in a working-class family, Benjamin Franklin’s early life was marked by hardship. He left school at the tender age of 10 and became an apprentice printer to his older brother. By the age of 17, he had moved to Philadelphia, armed with little more than ambition and self-education. Over the decades, Franklin built a formidable printing empire, publishing newspapers, books, and the immensely popular Poor Richard’s Almanack. His business acumen, along with subsequent government roles, positioned him among the wealthiest and most revered figures in the colonies.

However, Franklin was not inclined to hoard his riches. Retiring in his early 40s, he devoted the latter half of his life to public service, scientific pursuits, and diplomacy. His initiatives led to the establishment of America’s first public library, the University of Pennsylvania, and the eventual U.S. Postal Service. Notably, he served as ambassador to France, helped draft the Declaration of Independence, and negotiated the peace treaty that concluded the Revolutionary War.

Upon his death at age 84, Franklin’s wealth was significant enough to leave £1,000 each to Boston and Philadelphia. Notably, this sum came from his salary as Governor of Pennsylvania, a payment he believed was unwarranted. Franklin famously argued that public servants should not be paid and even attempted to embed this principle in the U.S. Constitution.

His choice of using pounds sterling instead of U.S. dollars can be explained by the nascent state of the American financial system—the dollar only became formally established with the Coinage Act of 1792, two years after Franklin’s death.

The Long Game

Franklin’s vision for the trust funds was inspired by a satirical essay by French mathematician Charles-Joseph Mathon de la Cour, which discussed the merits of allowing money to accrue over centuries through compound interest. Recognizing its potential for philanthropy, Franklin planned for the funds to be loaned to young tradesmen, who would repay the loans over ten years at 5% interest. After a century, part of the funds would be allocated for public works, while the remainder would continue to grow for another century before distribution.

Boston’s Big Bet

Boston opted for a more aggressive investment strategy, including the stock market for its trust fund. By the end of the first century, the fund had ballooned to $391,000, some of which contributed to the establishment of the Franklin Union—a trade school partially funded by Andrew Carnegie that continues today as the Benjamin Franklin Cummings Institute of Technology.

By 1990, Boston’s trust had reached nearly $4.5 million. However, when the time came to distribute the funds, complications arose. A Massachusetts law enacted in 1958 designated the money for the Franklin Institute technical school, but the state’s Supreme Judicial Court later ruled that the trust could not be prematurely terminated. This ultimately led to legal disputes regarding rightful claims—city officials, the state, and the school all laid claim to the millions. The Massachusetts Attorney General ruled that 26% should return to the City of Boston, while 74% would go to the Commonwealth of Massachusetts, in accordance with Franklin’s original stipulations.

Ultimately, both entities used their shares to enhance funding for technical education and training programs, fulfilling Franklin’s vision of supporting trades and applied sciences.

Philadelphia’s Slower Growth

In contrast, Philadelphia’s fund exhibited slower growth—reaching $172,000 by 1907, most of which was directed towards the construction of the Franklin Institute, a prominent science museum in the city. By 1990, the fund had climbed to $2 million.

Similar to Boston, debates arose over the distribution of the money. The city’s portion, roughly $520,000, was ultimately designated for grants to high school graduates entering trade careers, honoring Franklin’s original intentions. The remaining $1.5 million was allocated by the state legislature to various community foundations across Pennsylvania, forming Ben Franklin Funds that supported initiatives in education and community welfare, such as early childhood literacy and vocational training.

Legacy of a Financial Visionary

The next time you encounter Benjamin Franklin’s visage on the $100 bill, remember that it symbolizes more than just history. Franklin was arguably the first American to comprehend the significant potential of long-term investing. His understanding of the interconnectedness of money and time led to extraordinary outcomes over the years.

His £2,000 bequest has transcended time, growing to over $6.5 million within two centuries—funding schools, scholarships, scientific institutions, and job training, thereby impacting countless lives as Franklin intended.

He didn’t merely help to shape a nation; he meticulously crafted a financial legacy that endures more than 200 years later. With respect to the power of compound growth, consider this modern comparison: $100 invested in various ways would yield astonishing returns today:

- S&P 500 (since 1957): $70,000, assuming reinvested dividends

- Google at IPO in 2004: Roughly $4,000

- Warren Buffett’s Berkshire Hathaway since 1965: Roughly $2.6 million

- Bitcoin in 2010: A staggering $81 million

Meet William, a proud Bethel University alumnus with a fervent passion for lifestyle and culture topics. His keen interest doesn’t stop there; he’s also deeply engrossed in current events of all kinds. William dedicates himself wholeheartedly to this site, thriving on the collaborative energy he shares with Suzanne, his long-standing partner in crime.

Having navigated their university courses side by side for years, their teamwork on the site is nothing short of dynamic. Together, they bring a unique blend of insights, proving that two heads are indeed better than one in delivering compelling content.